Down 34% since the start of the year, Tesla (NASDAQ:TSLA) stock is now officially the worst-performing stock in the S&P 500.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

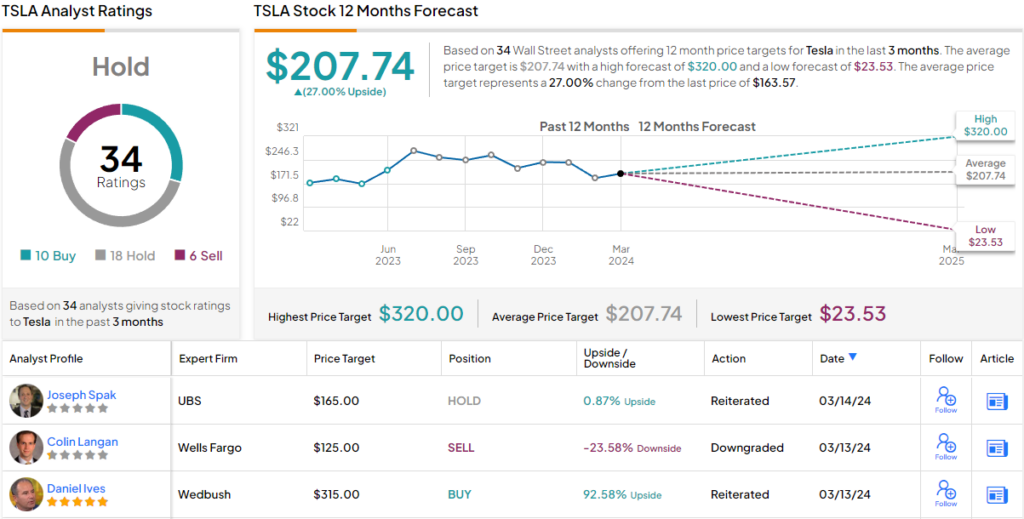

Realizing that Tesla stock is sinking, UBS analyst Joseph Spak made haste to abandon ship, lowering his price target on Tesla stock by $60 to $165 per share – but still hedging his bet and maintaining a Neutral rating on the shares. (To watch Spak’s track record, click here)

As the analyst explained, there’s a pretty significant near-term risk to owning Tesla shares, inasmuch as Tesla is due to report its Q1 2024 deliveries number early next month, and… things are not looking good.

Spak predicts Tesla will report only 432,000 deliveries for the quarter, 7% below his prior forecast and 10% below consensus estimates. On the plus side, 432,000 would still represent a tiny bit of growth year over year (up 2%).

And the news gets worse. According to Spak, 432,000 Tesla sales in Q1 should translate into about $0.43 per share in profit. That’s a lot less profit than the $0.64 that other analysts says they’re expecting. It would also be a staggering 41% less GAAP profit than Tesla earned in Q1 2023 – so not only would Tesla not be growing earnings. Earnings would actually shift into reverse.

Continuing the theme of worsening news, and extrapolating out from his expected Q1 results to guess how the rest of the year will look, Spak predicts total EV deliveries of only 1.96 million units this year. Wall Street as a whole is predicting 2.06 million. Again, this would represent some sales growth (by unit) – about 8% year over year. But on the earnings front Spak sees Tesla reporting full-year profits of only $2.32 per share – barely half the $4.30 per share Tesla earned last year, and also well below consensus forecasts for $2.92.

So why is all this happening to Tesla?

Slowing demand for EVs in Europe and the U.S. is one factor, and slowing production by Tesla (because why produce if the demand isn’t there?) is another. In China, what demand there is, is being eaten up largely by domestic Chinese producers, such as BYD, which just recently overtook Tesla as the world’s largest manufacturer of electric vehicles. Complicating matters further, as demand slows, manufacturers including both Tesla and its competitors are cutting prices, which means they’re cutting profit margins, which means… they’re cutting into their own profits.

After all the above, is there any hope left for Tesla? Any reason to retain Spak’s “neutral” rating?

If there is, it lies in Tesla’s long-awaited Model 2 electric car, which at a mooted price point of $25,000 might be cheap enough to reignite demand. It’s this “M2” that Spak places his hopes on, predicting that once the car arrives in 2026 or thereabouts, it will reignite growth, lifting Tesla from 2.2 million deliveries in 2025, to 3 million in 2026, to 3.9 million in 2027.

Of course, it still remains to be seen if the M2 will arrive on schedule, and if it does, whether it will sell, and if it does, whether it will sell profitably enough to reignite earnings growth for Tesla. In that regard, Spak’s neutral rating seems to tell investors clearly what he thinks the answer is to all these questions: Maybe.

All in all, the market’s current view on TSLA is a mixed bag, indicating uncertainty as to its prospects. The stock has a Hold analyst consensus rating based on 18 Holds recommendations, 10 Buys, and 6 Sells. However, the $207.74 price target suggests an upside potential of 27% from the current share price. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.