Tesla (NASDAQ:TSLA) had a slow start to the second quarter in Europe, as the EV maker clocked sales of 13,951 vehicles in April, a 2.3% drop from last year and the lowest since January 2023. This was a stark contrast from the 14% increase in industry-wide electric vehicle sales, according to the European Automobile Manufacturers’ Association.

EV Sales Growth Hasn’t Reached Full Potential

The increase in electric vehicle sales by 14% highlights a positive trend for the industry. However, this growth could have potentially been higher if not for certain challenges faced by EV manufacturers in Europe. Reduced subsidies in key markets like Germany and Sweden have impacted companies such as Volkswagen (OTC:VWAGY) and Mercedes-Benz (OTC:MBGAF), prompting adjustments to their product plans. Despite these hurdles, Volkswagen is gearing up for more plug-in hybrids, Mercedes-Benz is intending to continue producing combustion cars into the 2030s.

Overall, EV registrations remained stagnant in Germany, Europe’s largest EV market, and Tesla’s sales dropped by 32% in April in that country, lagging behind its peers. Nevertheless, the growing electric vehicle sales still signal that the demand for EV vehicles is not going to be subdued any time soon.

Tesla Is Also Struggling in China

For Tesla, Europe is the second market where it is struggling, following China. In April, the company sold 62,167 EVs manufactured in China, an 18% decline year-over-year, according to data from the China Passenger Car Association (CPCA).

This decline occurred despite new energy vehicle sales in China increasing by 33% year-over-year to 800,000 units in April. China defines new energy vehicles as those including battery-powered EVs and plug-in hybrids.

Is Tesla a Buy, Sell or Hold?

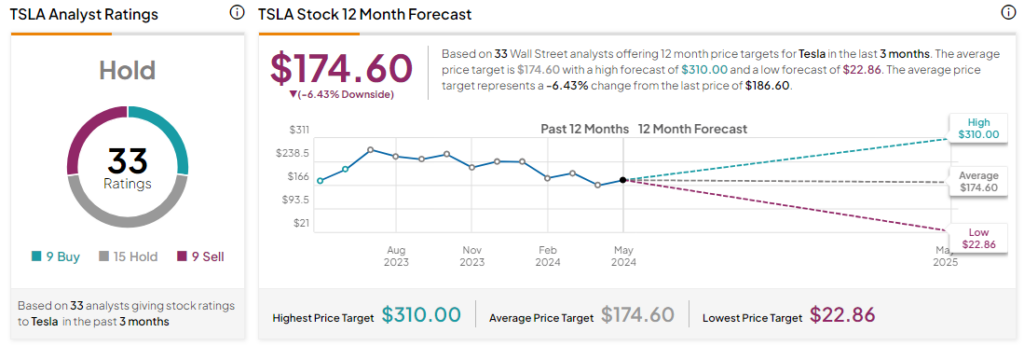

Analysts remain sidelined about TSLA stock, with a Hold consensus rating based on nine Buys, 15 Holds, and nine Sells. Year-to-date, TSLA has declined by more than 20%, and the average TSLA price target of $174.60 implies a downside potential of 6.4% from current levels.