Electric vehicle (EV) maker Tesla (NASDAQ:TSLA) continues to lose ground to rival BYD (OTCMKTS:BYDDY) in China. According to the China Passenger Car Association (CPCA), sales of Tesla’s China-made EVs declined 10.9% year-over-year to 74,073 units in September and were down 12% compared to August. In comparison, BYD, the maker of Dynasty and Ocean EV models, witnessed a nearly 43% year-over-year jump in its September sales to 286,903 units.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tesla’s Shanghai factory produces the Model 3 electric sedan and Model Y SUV. These EVs are not only sold to local customers but also exported to other markets. The decline in Tesla’s September China-made EV sales follows a 9.3% rise in August volumes compared to the prior year.

The competition in China, the world’s largest EV market, is intensifying with players like BYD, Nio (NYSE:NIO), Li Auto (NASDAQ:LI), and XPeng (NYSE:XPEV) enticing customers with new models and attractive offers. Tesla recently launched its revamped Model Y in China but kept the base price unchanged, reflecting the Elon Musk-led EV maker’s efforts to remain competitive and boost demand.

Last week, the company slashed Model 3 and Model Y prices in the U.S. yet again. The company has triggered a price war in the EV market to combat rising competition and macro pressures. It recently reported sequentially lower production and deliveries for the third quarter due to planned downtimes for factory upgrades. The company aims to deliver 1.8 million EVs in 2023.

Is Tesla a Buy, Sell, or Hold?

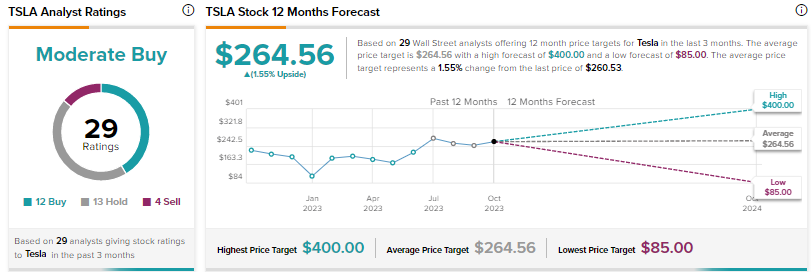

Analysts are cautiously optimistic about Tesla due to the impact of the company’s aggressive price cuts on its margins.

On October 6, Bank of America analyst John Murphy reiterated a Hold rating on Tesla stock following the news of the latest price cuts. As per the analyst’s estimates, Model 3’s pricing in Q3 declined 14% from a year ago and is 1% lower compared to Q2 2023. Meanwhile, he estimates Model Y’s Q3 pricing to have dropped 23.5% year-over-year and 1% from Q2 2023.

While Murphy acknowledges Tesla’s dominant position in the EV market, he remains on the sidelines due to several headwinds, including macro pressures, risks to EV demand, and growing rivalry.

With 12 Buys, 13 Holds, and four Sells, Tesla scores a Moderate Buy consensus rating. The average price target of $264.56 implies the stock could be range-bound from current levels. Shares have rallied over 111% year-to-date.