One of Tesla’s (TSLA) major shareholders, the State Board of Administration of Florida (SBA), has voiced its support for CEO Elon Musk’s proposed $1 trillion pay package for 2025. The SBA submitted its vote of confidence in a filing to the SEC on Monday, stating that it would support Musk’s compensation plan as it did for the 2018 performance award.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While some view the pay package as desirable for holding Musk’s long-term commitment to Tesla, others view it as excessive. Even Tesla Board Chair Robyn Denholm warned that if Musk were to walk away, Tesla could lose significant value, since many investors see his leadership as key to the company’s future.

Musk’s Pay Package Hangs in the Balance

Tesla has scheduled its Annual General Meeting on November 6, 2025, when shareholders will vote on Musk’s proposed compensation. The plan offers up to 423.7 million shares in 12 parts, tied to market value and performance goals. Market-cap targets range from $2 trillion to $8.5 trillion, with milestones for vehicle sales, Full Self-Driving (FSD) users, and Optimus/robotaxi deployments. Shares have different vesting periods and a full payout could dilute shares by about 12%.

The SBA is the first large shareholder to support Musk. However, proxy advisory firms Institutional Shareholder Services (ISS) and Glass Lewis have recommended voting against the proposal.

Nine Reasons to Support the Proposal

In its SEC filing, the SBA outlined nine reasons for endorsing the plan:

- Pay is fully tied to performance and aligns with shareholders

- Award size is linked to value creation and dilution depends on results

- Market cap goals are set in clear tiers with lasting performance focus

- Operational targets are measurable, strategic, and financially disciplined

- Long vesting and holding periods ensure Musk’s long-term commitment

- Includes CEO succession and performance integrity safeguards

- Runs over a 10-year performance window with no early vesting

- Pay may cause ownership gains and lasting dilution

- Designed for ambitious growth and shareholder value creation

The SBA concluded that this exact incentive model has proven itself twice before, in 2012 and 2018. It added that the potential dilution is minimal compared to expected value creation and that Musk benefits only when shareholders do.

Is Tesla Stock a Buy, Hold, or Sell?

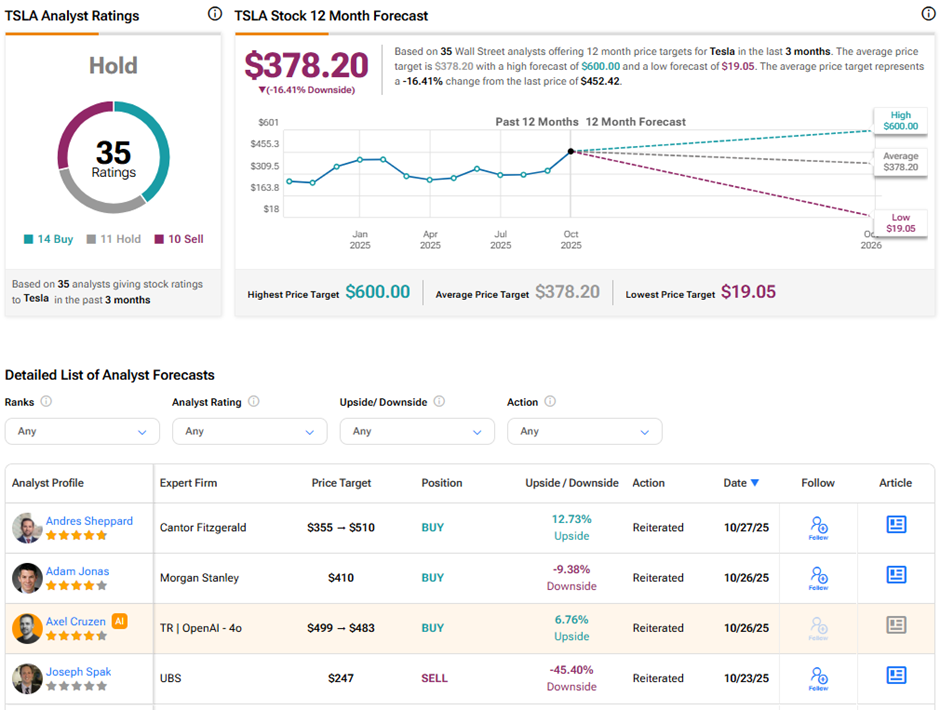

Analysts remain divided on Tesla’s long-term prospects. On TipRanks, TSLA stock has a Hold consensus rating based on 14 Buys, 11 Holds, and 10 Sell ratings. The average Tesla price target of $378.20 implies 16.4% downside potential from current levels. Year-to-date, TSLA stock has gained 12%.