Tesla (TSLA) enthusiasts are eagerly awaiting the electric vehicle (EV) giant’s product launch today, where it is expected to unveil a much-anticipated affordable model. The company released a cryptic teaser on Sunday, fueling investor enthusiasm about the new EV. Speculation centers on two possibilities that Tesla may launch either the advanced Roadster or a new low-cost model. This news drove TSLA stock up 5.5% yesterday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

CEO Elon Musk has not disclosed any details about the event, but a plant manager from Gigafactory Berlin may have hinted at a new vehicle. André Thierig indicated at an internal event yesterday that a lighter version of the Model Y will enter series production and begin deliveries “within a few weeks.”

Tesla Needs a Low-Cost EV to Offset Sales Decline

Tesla requires a more budget-friendly EV to counter a potential sales drop following the expiration of the EV tax credit on September 30. Global vehicle sales fell in 2024 and are expected to decline further in 2025. Even in China, where sales grew last year, a decline is anticipated for the first time. Launching a new model could help reverse this trend and attract buyers.

Earlier this year, Musk mentioned that the low-cost vehicle would be a simplified version of the Model Y. This new variant is expected to cost about 20% less to produce than the current Model Y, with Tesla targeting production of around 250,000 units annually in the U.S. by 2026.

On Friday, videos posted on X showed what appeared to be the new affordable Model Y driving near Giga Texas. The vehicle features the same Model Y body but lacks a glass hood and may include a front bumper camera.

The timing appears strategic, as Tesla likely anticipates a decline in demand now that the $7,500 tax credit has ended. The company reported strong third-quarter deliveries, probably boosted by a pull-forward in demand ahead of the tax credit expiration.

Back in June, Tesla announced that initial versions of the affordable car had already been built, with sales expected to begin in the fourth quarter and production scaling up more gradually than initially planned.

Is Tesla a Good Stock to Buy Now?

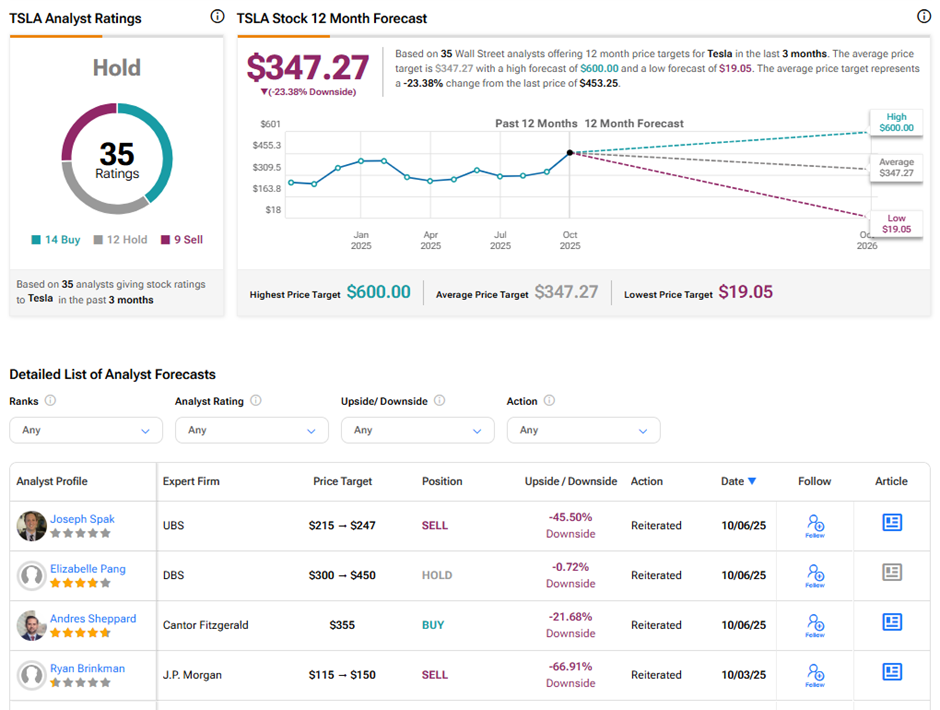

On TipRanks, TSLA stock has a Hold consensus rating based on 14 Buys, 12 Holds, and nine Sell ratings. The average Tesla price target of $347.27 implies 23.4% downside potential from current levels. Year-to-date, TSLA stock has gained 12.2%.