Electric vehicle maker Tesla (TSLA) has reportedly signed a major new battery supply deal. More specifically, according to the Korea Economic Daily, Tesla reached a $2.1 billion agreement with South Korean battery maker Samsung SDI (SSNLF) to supply battery cells over the next three years. However, the report notes that these batteries are intended for Tesla’s Energy Storage System (ESS) business, not its EVs. That means products like the Megapack and Powerwall could benefit from this new partnership.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This marks the first large-scale deal between Samsung SDI and Tesla after years of talks. While past speculation focused on Samsung producing Tesla’s signature 4680 battery cells, this new deal focuses instead on lithium iron phosphate (LFP) cells for stationary storage. Unsurprisingly, Samsung responded to inquiries by saying that “nothing has been finalized yet,” a typical statement before an official announcement.

The news comes shortly after Tesla signed another major LFP battery deal with LG Energy Solution, which is also based in South Korea. Up until now, Tesla has sourced its ESS batteries mainly from Chinese suppliers CATL and BYD (BYDDF), but trade tariffs on Chinese goods have pushed Tesla to diversify. In addition to new supplier deals, Tesla is working on building its own LFP battery cell production capabilities in the U.S. in order to reduce its reliance on Chinese sources for energy storage products.

What Is the Prediction for TSLA Stock?

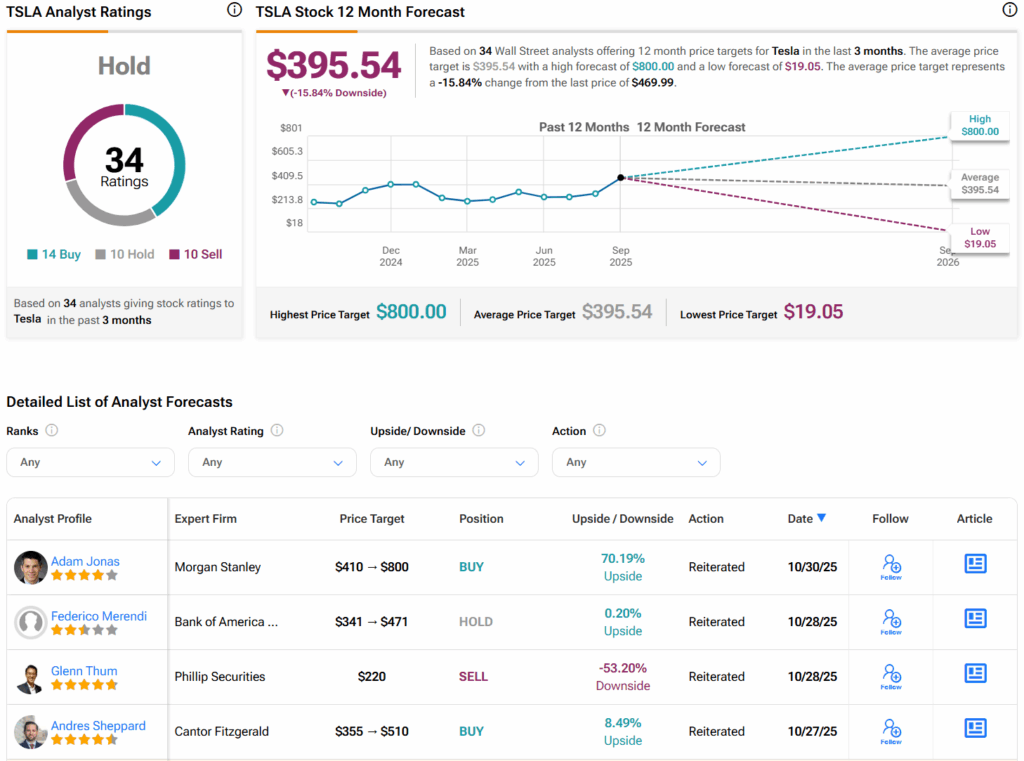

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 14 Buys, 10 Holds, and 10 Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average TSLA price target of $395.54 per share implies 15.8% downside risk.