Tesla (TSLA) shares rose 4.1% Monday morning, even as the company reported its ninth straight month of declining sales in Germany. Investors appear to be looking past the weak numbers and focusing on Tesla’s upcoming product launch on Tuesday, in which the EV giant may introduce a more affordable electric vehicle.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tesla’s Sales Slide in Germany

According to Germany’s Federal Motor Transport Authority (KBA), Tesla registered 3,404 vehicles in September, down 9.4% from the same month last year. Also, third-quarter sales dropped nearly 31% year-over-year, and total sales for 2025 so far are 14,845 vehicles, almost half of the 29,847 units sold in the same period last year.

This decline is notable because Germany’s overall battery electric vehicle (BEV) market grew nearly 32% in September. Tesla’s slowdown is primarily due to rising competition, a public backlash against CEO Elon Musk, and an aging lineup of vehicles.

It is worth noting that Chinese automaker BYD (BYDDF) is quickly gaining ground by offering lower-cost EVs. Its German sales jumped more than 20 times in September compared to last year, narrowing the gap with Tesla.

All Eyes on October 7

Tesla is expected to disclose a cheaper version of the Model Y on Tuesday, possibly called the “Model Y Standard.” The company posted teasers on X showing spinning wheels and headlights in the dark, followed by the date “10/7.”

With a major U.S. federal tax credit now expired, Tesla is under pressure to offer a lower-cost EV to stay competitive and attract new buyers. The upcoming model is rumored to be about 20% cheaper to produce than the current version.

Investors are expecting that this launch could help Tesla regain growth in key markets and beat rising competition.

What Is the Prediction for Tesla Stock?

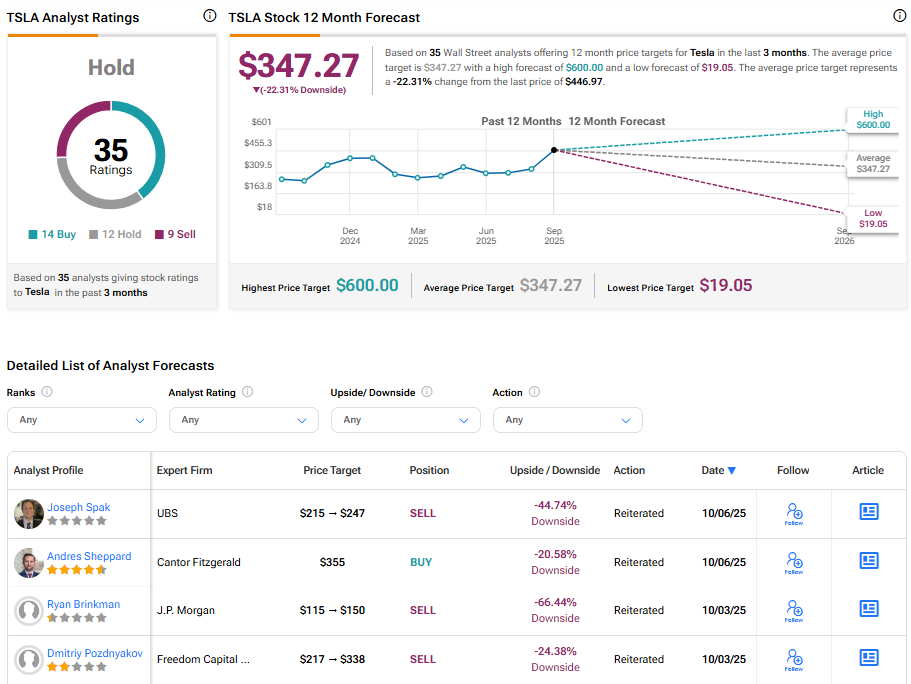

Turning to Wall Street, TSLA stock has a Hold consensus rating based on 14 Buys, 12 Holds, and nine Sells assigned in the last three months. At $347.27, the average Tesla price target implies a 22.4% downside risk. The stock has gained 84.3% over the past six months.