Tesla (TSLA) may have missed Wall Street’s earnings expectations in Q3, but some analysts are still bullish on the EV giant’s long-term prospects. Following the release of Q3 results, several Top analysts raised their price targets on TSLA stock, citing potential in the company’s AI, energy, and autonomous tech. Shares of the EV giant are up about 2% during Thursday’s trading session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Mizuho Sees Physical AI and Robotaxis to Drive Upside

Mizuho analyst Vijay Rakesh raised his price target on Tesla to $485 from $450, maintaining a Buy rating. He cited several key growth drivers, including Tesla’s push into AI hardware, which promises 40x performance gains, and its ramp-up of Robotaxi and full self-driving (FSD) initiatives into 2026-2027.

Rakesh also highlighted upcoming launches such as Optimus v3 humanoid robot pilots and Cybercab expected in early 2026. Moreover, low-cost EV models and FSD1 rollout in Australia and New Zealand are expected to support the company’s performance.

Overall, the five-star analyst noted TSLA is “well-positioned leading physical AI with Cybercab/FSD traction, humanoid longer term, offset by near-term demand headwinds.”

Cantor Fitzgerald Says Energy and Affordability Fuel Growth

Cantor Fitzgerald analyst Andres Sheppard raised his price target to $510 from $355, reiterating a Buy rating. He pointed to Tesla’s record quarterly vehicle deliveries and its strongest-ever energy storage deployment, driven by Powerwall sales and the ramp-up of Shanghai’s Megafactory.

Sheppard also praised Tesla’s move to introduce lower-priced vehicles, calling it a smart strategy to boost demand and regain EV market share. However, he cautioned that with Tesla stock trading near all-time highs, new investors may want to wait for a pullback.

Is TSLA Stock a Buy?

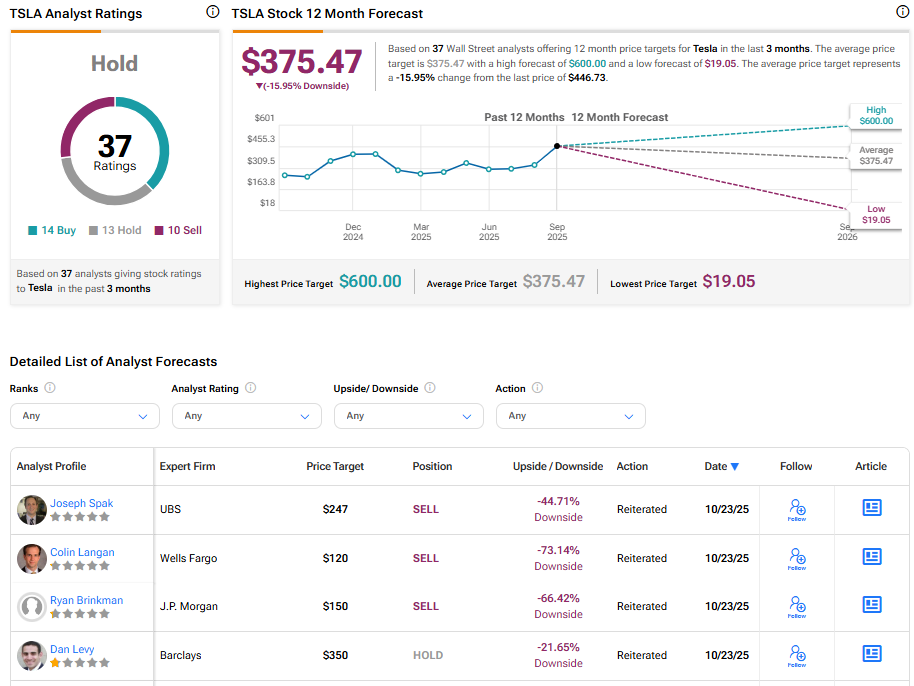

Turning to Wall Street, TSLA stock has a Hold consensus rating based on 14 Buys, 13 Holds, and 10 Sells assigned in the last three months. At $375.47, the average Tesla price target implies a 15.95% downside risk. The stock has gained 69.2% over the past six months.