It’s almost time for Tesla (TSLA) to announce its Q4 deliveries. At the close of a year that featured plenty of twists and turns, the trends seen ahead of the important readout appear to be in Tesla’s favor.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

That at least is the opinion of Wedbush analyst Dan Ives, who notes that over the past month, there has been some “clear price stabilization globally with Tesla prices upticking in a number of regions including China.”

“With the last week of December now here we believe Tesla is tracking slightly ahead of the 480k delivery unit bogey for 4Q based on strong data out of the key China region that gives us incremental confidence in our bullish call into 2024,” the 5-star analyst went on to say.

In fact, while earlier in the year, the EV leader was hit by a “Category 5 storm” in China, with the company now raising prices and witnessing steady demand in this major region, Ives believes Q4 TSLA volumes in China “should hit another record.”

Heading into the new year, most of the Street talk on Tesla involves the impact of price cuts on the margin profile. Ives thinks margins have now “stabilized” and should push higher from here. During 2024, Auto GM (gross margin) should once again be back above the “key 20% threshold.”

As for 2024 volumes, year-over-year unit growth between 25%-30% is “very achievable” and should see deliveries land in the 2.2 million to 2.3 million range. Driven by Model Y sales in China and Europe, there could even be some “upside surprises” in the cards.

It should also be remembered that despite current headwinds, the move to an EV world has yet to fully play out with Tesla poised to reap the rewards of ongoing adoption. “While overall EV demand has clearly moderated globally, we are still in the early days of this massive transformation with Tesla leading the way as we estimate by 2030 roughly 20% of autos will be EV based,” Ives further said.

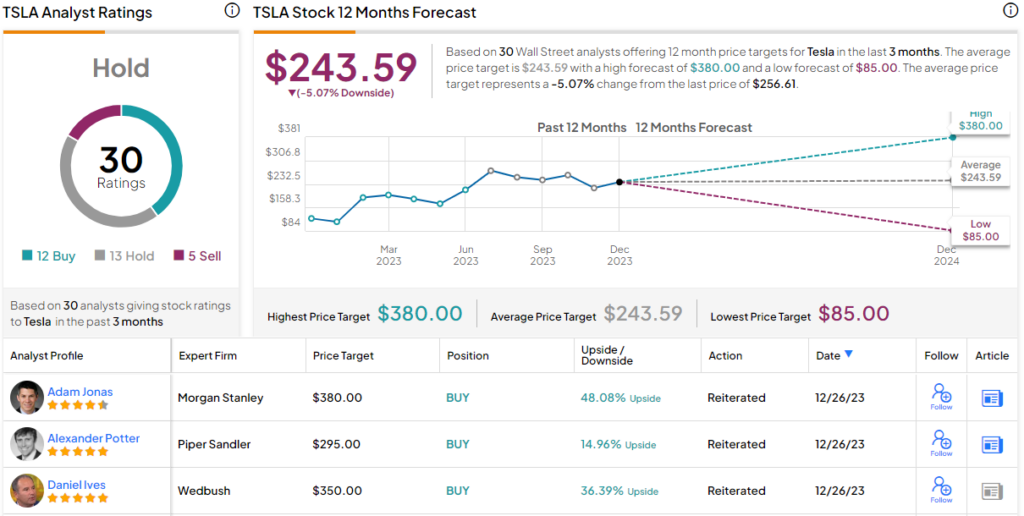

All told, Ives reiterated an Outperform (i.e., Buy) rating to go along with a $350 price target. The implication for investors? Upside of 36% from current levels. (To watch Ives’ track record, click here)

However, not all on the Street are quite as confident. Elsewhere, the stock claims an additional 11 Buys, 13 Holds and 5 Sells, all coalescing to a Hold consensus rating. The shares also appear to have overshot here; the $243.59 average target implies the stock will post a 5% decline in the year ahead. (See Tesla stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.