Tesla (NASDAQ:TSLA) stock has generated a strong following and felt unstoppable just a few years ago. In less than two years, Tesla stock surged by more than 1,000% from its pandemic low. The stock peaked in November 2021 and is more than 50% off that high. Tesla followed the market trend of falling in 2022 while coming back triumphantly in 2023. Most of the other Magnificent Seven stocks are off to a great start this year, with the exception of Apple (NASDAQ:AAPL), which is down 7% year-to-date.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

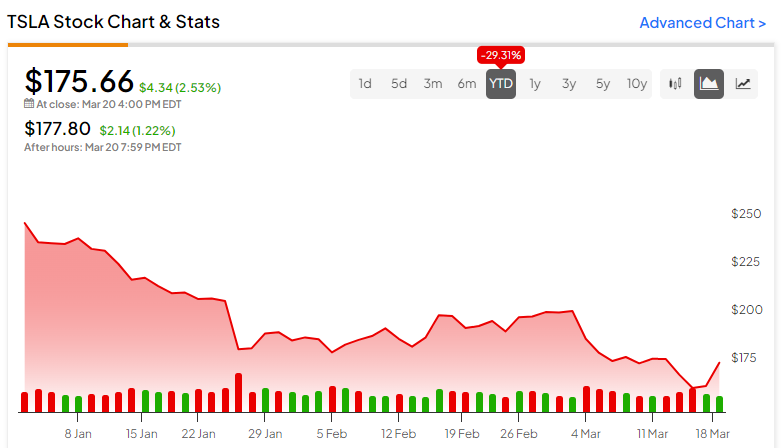

Investors have reasons to feel optimistic about Apple’s rebound, but there isn’t much optimism for Tesla at the moment. A high valuation relative to other automobile companies, significant revenue deceleration, and rising competition in China are several concerns for Tesla investors to keep in mind. The stock is down 29% year-to-date, but the losses can continue. I am currently bearish on the stock.

Tesla Is an Automobile Company

Tesla has more going for it than just its cars. The company generates revenue through software updates, energy generation, and a few other sources. These revenue streams are creative ways to increase the company’s profit margins. However, the company still depends on vehicle sales to propel its business and generate revenue from its other opportunities.

Automobile revenue still makes up the overwhelming majority of Tesla’s total revenue. The electric vehicle manufacturer generated $21.6 billion in automobile revenue in Q4 2023. The company generated $25.2 billion in total revenue. Therefore, automobile sales still make up 85.7% of the company’s total revenue.

Forecasts of slower growth can make more investors aware that most of the company’s total revenue comes from its electric vehicles rather than software and add-ons. The stock currently trades at a 41x P/E ratio, while most automobile stocks hover at around 10-15x P/E ratios.

Automobile sales only grew by 1% year-over-year, while energy generation and services revenue grew by 10% and 27% year-over-year, respectively. Those two segments need to grow at much faster rates to support the idea that Tesla is more than a car company.

Despite those double-digit growth rates, low growth in automobile sales resulted in a tepid company-wide 3% year-over-year revenue growth rate. It wasn’t that long ago when Tesla regularly reported revenue growth rates well above 20% year-over-year.

The Company Is Losing Market Share

Chinese EV makers are catching up to Tesla. In fact, BYD has already overtaken Tesla as the largest EV seller in the world. Tesla enjoyed a first-mover advantage in the EV industry but is losing some of its market share.

A broader slowdown in China’s EV sales can lead to more trouble for the beleaguered corporation. Sales were up year-over-year but dropped by 33% within one month.

Domestic competitors are also biting into Tesla’s apple. Ford (NYSE:F) reported an 81% EV sales surge in February, and results like that can impact Tesla’s revenue. Tesla still remains the premier electric vehicle brand. The car is viewed as a status symbol, similar to Apple products. However, any competition can pressure profit margins and bring the stock’s valuation into the spotlight.

Those lower profit margins combined with a 27% year-over-year increase in operating expenses can put more pressure on the stock.

Tesla Stock Has Always Been Priced for Perfection

Tesla never won the affection of value investors. The stock has always traded at a lofty valuation that relied on future revenue and earnings growth to justify the current valuation. The stock’s P/E ratio has regularly been above 30 and has hovered above 80 in some instances.

Significant revenue deceleration limits net income growth, assuming the company can report positive growth rates for its top and bottom lines. The stock may have a 41x P/E ratio, but it currently trades at a 55x forward P/E ratio and a 2x PEG ratio. It’s harder to justify those metrics when growth is slowing down, and 85.7% of all revenue comes from automobile sales.

The stock’s growth rates no longer resemble a growth stock, which leaves shares vulnerable to a steep correction, even after a 29% year-to-date decline. Tesla was “the” stock in 2021, but that title can shift to other companies. Nvidia (NASDAQ:NVDA) currently holds that title and the momentum associated with it.

Is TSLA Stock a Buy, According to Analysts?

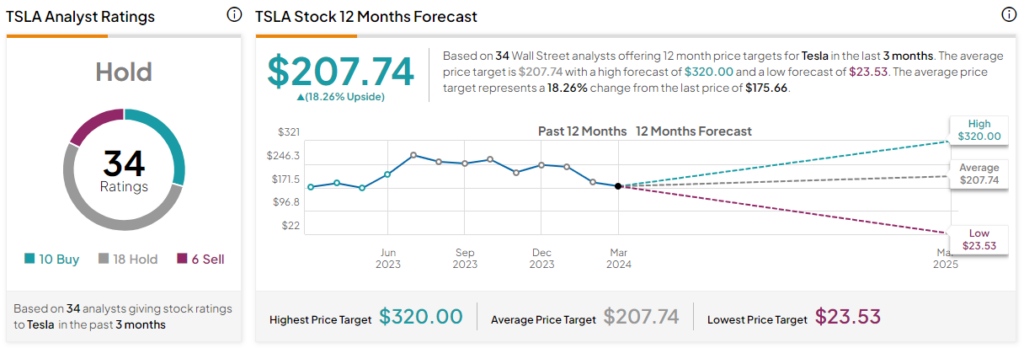

Tesla stock has a Hold consensus rating based on the ratings of 34 analysts. The stock has 10 Buys and six Sell ratings. The remaining 18 analysts rated the stock as a Hold. The average TSLA stock price target of $207.74 implies 18.3% upside potential.

The Bottom Line on Tesla Stock

Tesla no longer fulfills the conditions for being treated as a magnificent stock. The corporation faces noteworthy headwinds that are bound to get worse in the future. Competition will heat up in the United States and abroad. Further, profit margins will get tighter, which will put Tesla’s current valuation into question.

The stock market is filled with many opportunities. Tesla stock doesn’t seem like the best opportunity at this time.