Shares of the electric vehicle (EV) titan Tesla (NASDAQ:TSLA) keep sliding. It closed 4.54% lower on Wednesday and is down about 32% year-to-date. Given this decline, TSLA is now the worst-performing S&P 500 stock. Moreover, its stock has significantly underperformed other companies, which are part of the magnificent seven.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Yesterday’s decline in value came after Wells Fargo analyst Colin Langan cut his rating on TSLA stock from Hold to Sell. Langan reduced the price target from $200 to $125, citing earnings growth concerns and a lofty valuation.

Overall, year-to-date weakness in TSLA stock is due to the softening of demand and increased competition in the EV space, especially in China. Further, the company’s strategy to cut prices to accelerate growth is failing to boost volumes. In fact, it has taken a toll on its margins, which have consistently declined over the past several quarters.

Analyst Says the Selloff in TSLA Stock Is Overdone

While Langan is bearish, Wedbush analyst Daniel Ives sees the selloff in Tesla stock as overdone. Ives reiterated a Buy on Tesla on March 13. Further, his price target of $315 implies 85.86% upside potential from current levels.

Ives expects demand to stabilize for Tesla as the year progresses. Further, the analyst sees price cuts to moderate and the company’s margins to benefit from improving battery costs and production efficiency.

Will Tesla Bounce Back?

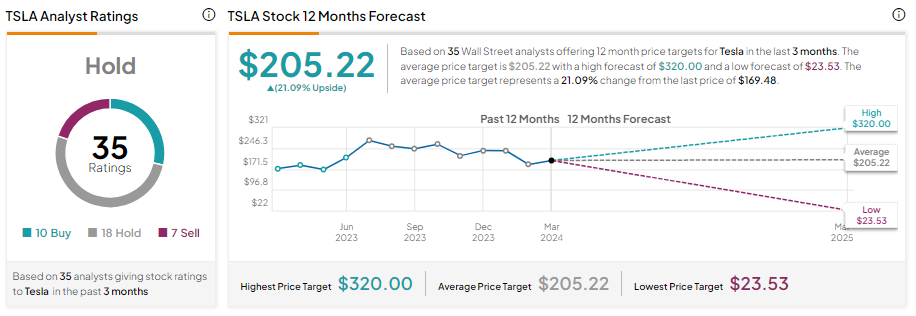

Based on analysts’ average price targets, Tesla stock could witness a decent recovery over the next 12 months. However, near-term demand and margin concerns keep analysts sidelined on Tesla stock.

It has 10 Buy, 18 Hold, and seven Sell recommendations for a Hold consensus rating. Analysts’ average price target on TSLA stock is $205.22, implying an upside potential of 21%.

The Takeaway

Tesla focuses on growing its output, reducing costs, increasing investments in future growth initiatives, and launching a low-cost vehicle. All of this supports its long-term bull case. However, demand headwinds and pressure on margins could continue to pose challenges in the near term.