Tesla stock (TSLA) dipped in early Tuesday trade even as Wall Street grew more bullish. Canaccord analyst George Gianarikas lifted his price target to $490 from $333 but the shares eased 0.9% to $439.09 in premarket action. Despite the red tick, September has already been an extraordinary month for the stock. Shares have surged 33% this month and 37% across the quarter, making it Tesla’s best run since late 2024 and placing all-time highs back in play.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For investors, the slip does little to dim the bigger picture. September could end up as one of Tesla’s top ten months ever if the stock closes above $461.24. That would eclipse its post-election surge in November 2024 and put momentum firmly back on the bulls’ side.

Analysts Catch Up to the Rally

Gianarikas admitted he wrestled with whether to downgrade the stock. “We wrote a note in early January where we underwent the same [downgrade] debate and inked our struggles on paper… We kept our Buy rating. And despite the volatile ride since, we’re glad we did,” he told clients. The call reflects renewed confidence that Tesla’s growth engines extend well beyond cars.

He highlighted strong third-quarter deliveries, the arrival of new models, and increasing traction in the company’s energy business. He also pointed to the optionality in artificial intelligence, from self-driving technology to humanoid robots, as reasons the stock can keep running higher. For Gianarikas, the balance of risk and reward still favors the bulls even after a sharp run.

Tesla Price Targets Trail Where Shares Trade

The average Tesla price target now stands at roughly $345, which is about $31 higher than where it was just one month ago. That still lags the stock price by more than $90. This gap is not unusual. Historically, Tesla has often traded well above consensus targets as analysts struggle to keep up with its volatility and growth narratives.

At the start of September, Tesla shares were trading almost exactly at the Street’s average target. The surge since then has left analysts scrambling to revise their numbers. Even as price targets climb, they remain in Tesla’s rearview mirror. This mismatch is a reminder of just how quickly sentiment can turn when momentum takes over.

Traders Watch Key Levels

Technical analysts say the stock is now at a critical inflection point. “Momentum tends to be very strong in the stock once a major resistance zone is finally overtaken,” said Frank Cappelleri, founder of CappThesis. He added, “I do think there’s a chance Tesla can make a new high,” putting $520 on his radar.

Tesla’s prior peak sits near $489 from December. Breaking through that level could unleash another wave of buying as chart-watchers pile in. For now, the stock is consolidating just below that ceiling, but the trend since September suggests momentum remains intact. The next few sessions could decide whether Tesla extends its rally into record territory.

AI and Energy Drive Tesla’s Story

For many investors, Tesla’s future is no longer only about electric vehicles. The company’s progress in artificial intelligence is commanding a premium. Tesla trains cars to drive themselves and develops humanoid robots designed to handle everyday tasks. That narrative keeps traders focused on long-term potential, not just near-term delivery numbers.

Energy is also becoming a bigger piece of the Tesla story. Growth in storage and services adds a recurring revenue stream to the company’s business, making it less dependent on volatile vehicle sales. Analysts see this diversification as one reason why the stock has managed to outrun average target prices time and again.

Risks that Could Cool Tesla’s Rally

Still, Tesla’s hot streak comes with risks. A weaker-than-expected delivery report for the third quarter would quickly puncture optimism. Pressure on margins from price cuts or new model launches could also weigh on earnings. After such a sharp rally, the stock could be vulnerable to profit-taking even on good news.

Policy and incentives remain another wild card. Tax credits and government spending bills can dramatically shift the economics of EV adoption. Tesla’s history shows how fast sentiment can change when external conditions shift, and investors will need to watch the policy environment closely.

Key Takeaway

Tesla just got another big price target boost and a reaffirmed Buy rating, yet shares slipped. The divergence reflects how far and how fast the stock has already run this month. Still, the broader setup remains bullish. Analysts are catching up, momentum traders are watching resistance levels, and AI keeps the growth story alive. Whether or not Tesla breaks through $489 in the near term, September has already cemented itself as one of the stock’s defining months.

Is Tesla Stock a Buy, Hold, or Sell?

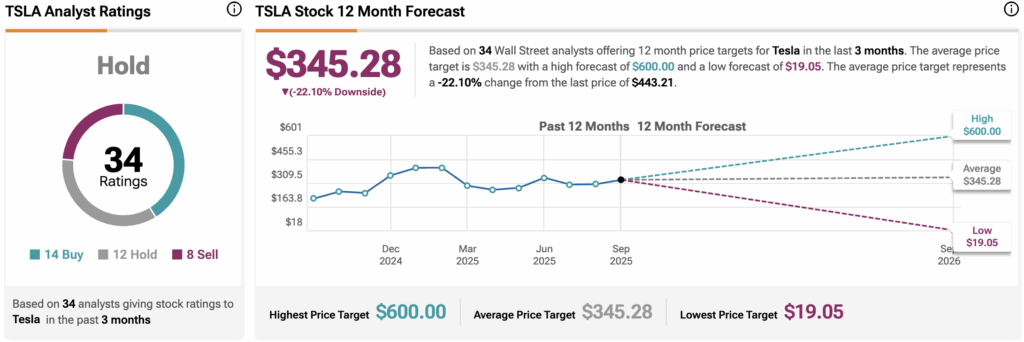

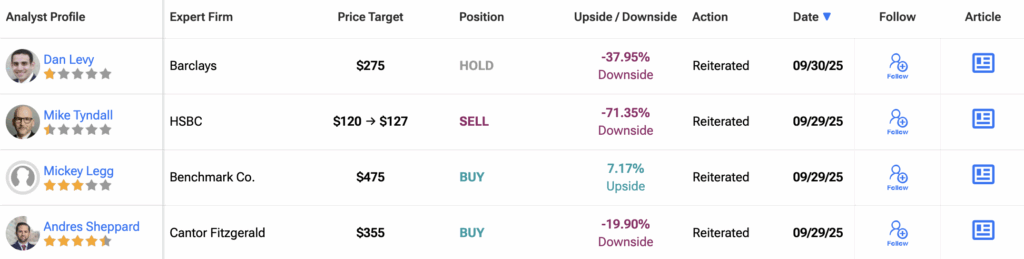

Despite the latest bullish price target from Canaccord, Wall Street remains split on Tesla’s trajectory. According to 34 analyst ratings in the past three months, the consensus sits at a Hold, with 14 calling the stock a Buy, 12 rating it Hold, and eight recommending Sell.

The average 12-month TSLA price target stands at $345.28, which implies a 22% downside from the current price level.