Tesla’s (NASDAQ:TSLA) Q3 earnings report was something of an all-round disaster with plenty of metrics, including soft vehicle sales and the margin profile, disappointing Wall Street.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, it is widely accepted that Q4 should offer some improvements. In fact, on the sales side, Barclays analyst Dan Levy thinks the Street is underestimating the expected volumes.

Going by October data for worldwide EV sales and November registrations and production in Europe and China, Levy reckons Tesla will notch 490,000 deliveries in the quarter, above his previous 480,000 forecast (which also remains the Street’s estimate). “This implies a solid sequential improvement from the soft 3Q23 result of 435k units,” notes the analyst. That figure would also bring the year’s total to 1.81 million units, enabling Tesla to just meet its 1.8 million target for 2023.

Levy thinks the better-than-expected performance will be down to the expiration of subsidies in the US, France, and Germany. Before taking into account customer-specific eligibility, these apply to ~15% of Tesla’s annual volume.

The €5,000 EV subsidy on the Model 3 in France ran out on Dec 15 with other credits running out in the US and Germany at the end of the year. “Taken together,” says Levy “we believe these subsidy expirations will likely create a sense of urgency in December for eligible consumers, further bolstering the delivery wave.”

The pull-forward might provide a near-term boost, but it is set to have implications further down the line. While Levy is above consensus on Q4 deliveries, looking ahead to next year, he thinks the Street is being too optimistic and he continues to anticipate Tesla will make “negative revisions on ’24 delivery estimates.”

For 2024, Levy is calling for 2 million deliveries, suggesting low double-digit year-over-year growth and below the Street’s forecast of 2.2 million. “From our conversations with the buyside, our sense is that expectations are for ’24 unit sales to be in line with or lower than our estimate,” he summed up.

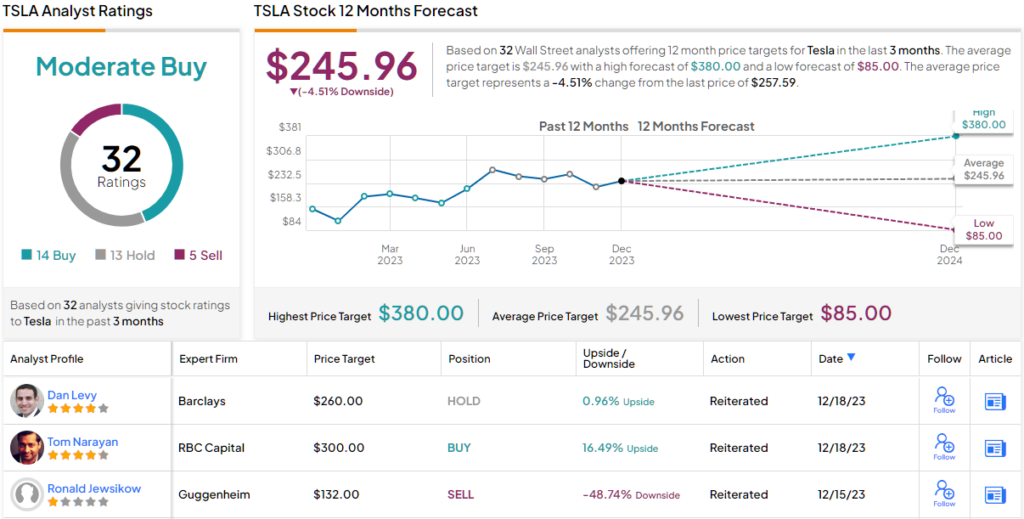

To this end, Levy remains on the sidelines for now, with an Equal Weight (i.e., Neutral) rating and $260 price target, suggesting the shares are just about fully valued. (To watch Levy’s track record, click here)

As for other analysts, 12 of Levy’s colleagues join him on the fence, and with the addition of 14 Buys and 5 Sells, the stock claims a Moderate Buy consensus rating. Going by the $245.96 average target, shares will remain rangebound for the time being. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.