Tesla (NASDAQ:TSLA) stock fell about 6% in Wednesday’s after-hours of trading due to weak Q4 results. The electric vehicle (EV) giant failed to meet the Street’s expectations on both revenue and profitability. Adding to the challenges, Tesla’s leadership expects a “notable” dip in volumes for 2024 compared to the previous year.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

During the Q4 conference call, Tesla’s management stated that the growth rate of vehicle volume will decelerate in 2024 as the company shifts its focus towards the launch of the next-generation vehicle at Gigafactory Texas. It’s worth noting that Tesla experienced a 38% year-over-year increase in volumes during 2023.

Meanwhile, Tesla’s cost of goods sold per vehicle declined sequentially in the fourth quarter, and the company is focused on growing output and identifying further cost efficiencies. Nonetheless, its operating margin could remain under pressure due to the reduced vehicle average selling price and increased operating expenses driven by investments in artificial intelligence (AI) and other research and development projects.

Analysts Weigh In

Following the release of Q4 earnings, TD Cowen analyst Thomas Boyes reiterated a Hold recommendation. Boyes pointed out that Tesla’s recent developments have shifted from unfavorable to even more challenging, reflecting lower-than-expected performance in Q4 and weak guidance.

While the analyst views the announcement of a next-gen offering as positive, he sees concerns stemming from decelerating growth and potential margin challenges from ongoing price reductions. Boyes has revised the price target down to $180 from the previous $200.

Echoing similar sentiments, Goldman Sachs analyst Mark Delaney also maintained a Hold on TSLA stock. Vehicle price reductions and increased competition in EVs keep Delaney sidelined.

Is Tesla Buy, Hold, or Sell?

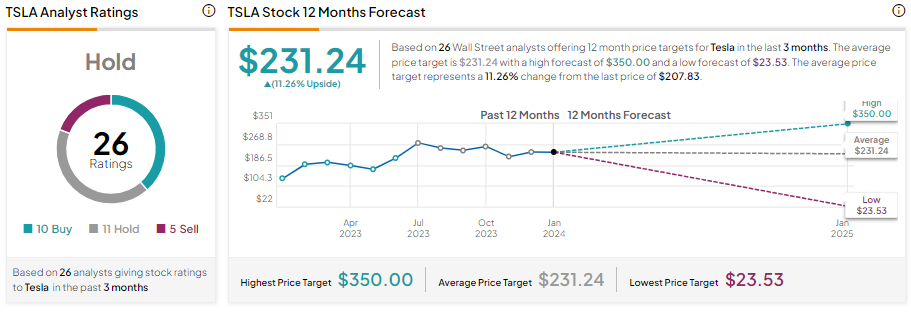

Tesla stock has dropped over 16% year-to-date. Further, analysts remain sidelined on TSLA stock. It has 10 Buy, 11 Hold, and five Sell recommendations for a Hold consensus rating. Analysts’ average price target of $231.24 implies 11.26% upside potential.