EV (electric vehicle) giant Tesla (NASDAQ:TSLA) is planning to introduce the refreshed version of its popular Model Y from its Shanghai plant, Bloomberg reported. The move is seen as Tesla’s response to the escalating competition from local players in China as they aggressively focus on ramping up production and launching new models.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

According to the report, Tesla is engaged in preparatory activities for the revamped Model Y SUV (sport utility vehicle). Further, mass production is expected to start in mid-2024.

Though Tesla is intensifying its efforts to navigate competitive challenges, renowned hedge fund manager Cathie Wood is increasing her stake in the EV titan after trimming her holdings earlier this year. Wood anticipates that Tesla will capture additional market share, especially as competitors push their investment in EVs. With this backdrop, let’s look at analysts’ recommendations for TSLA stock.

What Do Analysts Say About Tesla?

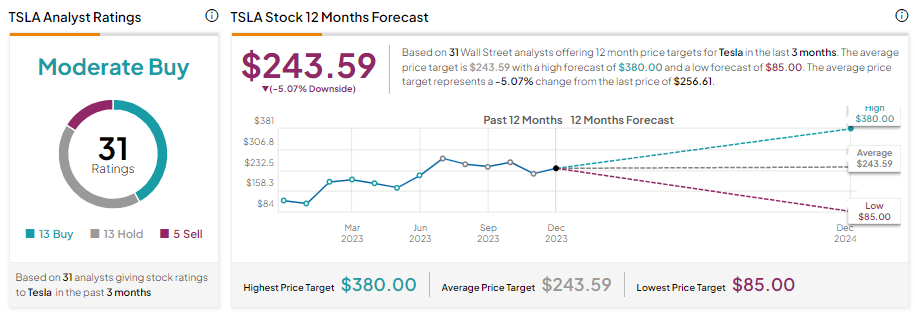

Tesla stock has rallied over 100% year-to-date. While Tesla stock appreciated significantly in value, increased competition, macro headwinds such as persistently high interest rates, and margin headwinds keep analysts cautiously optimistic.

With 13 Buy, 13 Hold, and five Sell recommendations, TSLA stock has a Moderate Buy consensus rating. Further, analysts’ average price target of $243.59 implies 5.1% downside potential from current levels.