There are certain countries that are increasingly catching the attention of companies these days. Vietnam recently landed a lot of new interest in electronics manufacture, for example. Perhaps the biggest of all is India, and electric vehicle stock Tesla (NASDAQ:TSLA) is looking to get in as well, stepping up its battery manufacturing therein.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tesla recently brought a plan to Indian officials, detailing how it would like to both produce and ultimately sell battery storage systems in India. It’s part of a larger goal in which it can offer a kind of electric car that sells for $24,000, or just shy of two million rupees. Given that the average Indian makes about 383,000 rupees per year, that may not be the best goal. Meanwhile, the battery storage system concept won’t be getting much in the way of incentives from the government but instead would allow for a “fair business model” and offer direct subsidies to customers.

Tesla ultimately wants to cultivate both residential and industrial customers for its storage systems, and it’s going to need all the help it can get. The firm also unveiled the “Project Highland” re-release of the Model 3, and reactions have been mixed. Several features users predicted are on board, while some features that users liked have been removed, such as a gear selector moved to the touch screen instead of on steering column stalks. For some, the changes are actually enough to turn them off from buying one.

Is Tesla Stock a Good Buy Right Now?

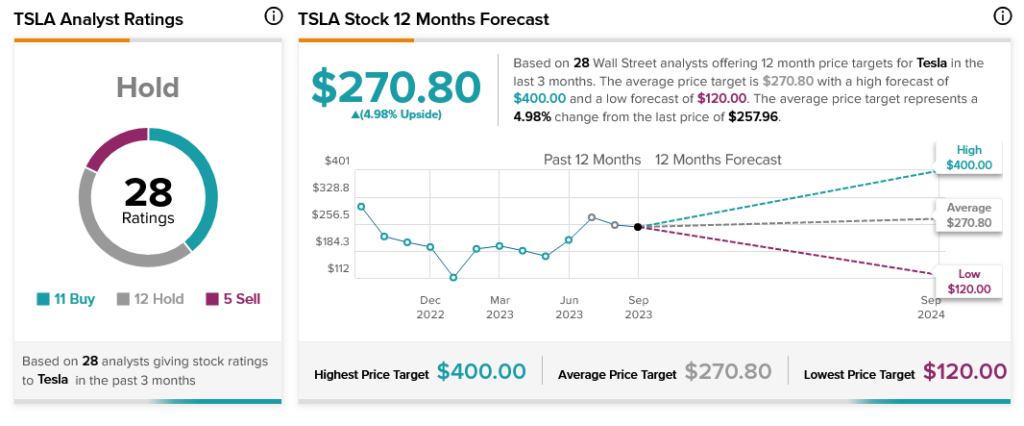

Meanwhile, Tesla’s analyst support is starting to shrivel up as well. Currently, Tesla stock is considered a Hold, supported by 11 Buy ratings, 12 Holds, and five Sells. Further, Tesla stock also offers investors a modest 4.98% upside potential thanks to its average price target of $270.80.