Tesla (NASDAQ:TSLA), the electric vehicle giant, has increased the discounts it provides on in-stock inventory at its U.S. stores. The company’s objective is to lower stock levels and bolster sales before the end of the second quarter.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company has recently implemented a reduction of more than $7,500 on Model S and Model X vehicles. In addition to the price cut, TSLA is offering extra incentives, including three years of free Supercharging.

In addition to the aforementioned benefits, prospective Tesla buyers have the opportunity to receive an additional $1,000 discount by utilizing a referral code provided by an existing customer. Furthermore, all models of the Tesla Model 3 and Model Y qualify for the full federal electric vehicle (EV) tax credit, amounting to $7,500. These numerous discounts and offers enhance the attractiveness of Tesla’s vehicles to potential buyers and have the potential to contribute to a successful sales push for the company.

It is worth noting that Tesla is offering brand-new cars as well as service loaners, test-drive vehicles, and demo cars for sale. Interestingly, even vehicles that have been driven for a few miles are eligible for additional discounts.

Is Tesla a Buy or Sell Today?

TSLA stock has skyrocketed more than 141% in 2023 so far. Tesla is capitalizing on its dominant position in the market for battery-powered vehicles, which is contributing to its success. Furthermore, the company’s ongoing initiatives to expand production, generate revenue by allowing other automakers such as General Motors (GM) and Ford (F) to utilize its supercharging network, and introduce new vehicle models are expected to continue bolstering its performance.

However, given the economic uncertainties and intense competition in the EV market, Wall Street analysts are cautiously optimistic about TSLA stock. This is based on 16 Buy, 10 Hold, and four Sell recommendations. Further, the consensus 12-month price target of $213.12 implies a downside potential of 18.2% at present.

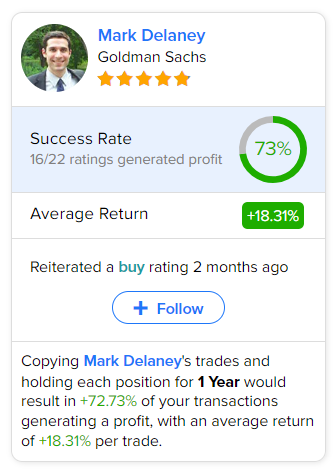

Remarkably, Goldman Sachs analyst Mark Delaney is the most accurate analyst for TSLA. Copying the analyst’s trades on this stock and holding each position for one year could result in 73% of your transactions generating a profit, with an average return of 18.31% per trade.