Tesla (NASDAQ:TSLA) is offering more incentives to buyers for its Model Y. According to the company’s website, the EV giant is now offering a 0.99% annual percentage rate (APR) on eligible purchases of the new Model Y, a significant decrease from 6.49% just a week ago. In contrast, the APR rate for the Model 3 remains at 6.49%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The APR indicates the total cost of financing for the purchase of the car, which may vary among lenders due to their fees and rate-setting methods. Tesla is offering this deal from May 10 to May 31, providing financing at a lower, below-market rate. The Model Y is the company’s best-selling vehicle, with sales of 96,729 units in Q1, up by 1% year-over-year.

Why is TSLA Offering the New Deal?

This offer by TSLA could be a bid by the company to increase EV sales amid slowing demand for its vehicles. Since late 2022, the company has been on a price-cutting spree to boost sales amidst rising competition and market saturation in the high-end EV segment.

The company’s vehicle deliveries declined by 9% year-over-year to around 387,000 units in the first quarter. Additionally, TSLA’s sales decreased by 8.5% year-over-year to $21.31 billion.

Is Tesla a Buy, Sell, or Hold?

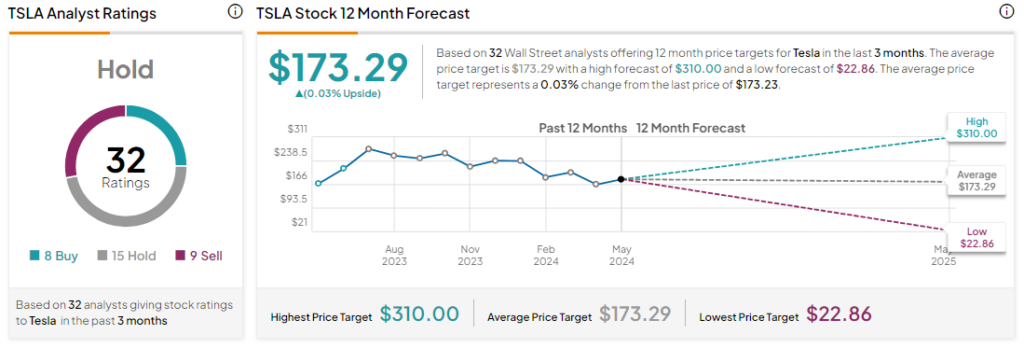

Analysts remain sidelined about TSLA stock, with a Hold consensus rating based on eight Buys, 15 Holds, and nine Sells. Year-to-date, TSLA has declined by more than 25%, and the average TSLA price target of $173.29 implies that TSLA stock is priced in from current levels.