Electric vehicle (EV) sales in the U.S. market reached record levels in the third quarter of 2023, growing about 50% year-over-year to 313,086, as per research from Cox Automotive, which cited data from Kelley Blue Book. While overall U.S. EV sales surpassed 300,000 for the first time in Q3, leading EV maker Tesla (NASDAQ:TSLA) lost ground in the domestic market despite price cuts, reflecting the impact of rising competition.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tesla’s U.S. Market Share Declines

Tesla’s sales increased 19.5% year-over-year to 156,621 vehicles. However, the company’s market share declined to 50% in Q3 2023 from 59.3% in Q2 and 62.4% in Q1. While Tesla remains the undisputed market leader in the U.S., other players are gradually expanding their EV presence and gaining traction.

For instance, Ford’s (NYSE:F) U.S. EV market share increased to 6.7% in Q3 2023 from 5% in Q2. Ford, which is currently facing a massive UAW union strike, saw its Q3 EV sales rise 14.8% to 20,962 units, making it a distant No. 2 in the domestic EV market. Meanwhile, Rivian’s EV share improved to 5% from 4.3%, while the market share of Hyundai increased to 6.3% from 4.4% in the second quarter of 2023.

Additionally, Cox Automotive highlighted the rapid rise in U.S. EV sales of German luxury brands Audi, BMW (BMWYY), and Mercedes (MBGAF). In particular, Q3 EV sales of BMW and Mercedes jumped nearly 200% and 284%, respectively. Audi’s EV sales increased by about 94%.

While Cox Automotive thinks that Tesla’s much-awaited Cybertruck might reverse the downward trend in market share, it cautioned that competition from Ford, Rivian (NASDAQ:RIVN), and General Motors’ (NYSE:GM) Chevrolet could likely impact Tesla’s electric pickup truck’s volume potential. Earlier this year, Tesla CEO Elon Musk said that the company intends to have a “great delivery event” for the Cybertruck in the third quarter, but no such event took place, signaling further delay in Cybertruck deliveries.

The company recently reported a sequential decline in its Q3 production and deliveries due to planned downtimes for factory upgrades. It is worth noting that Tesla’s sales of China-made EVs also declined in September. In contrast, rival BYD (OTCMKTS:BYDDY) continues to shine and grow rapidly in China, the largest EV market.

Is Tesla a Good Stock to Buy Right Now?

Tesla shares have rallied 110% year-to-date. However, several analysts are cautious about the stock due to rising competition and the impact of the company’s aggressive price cuts on margins.

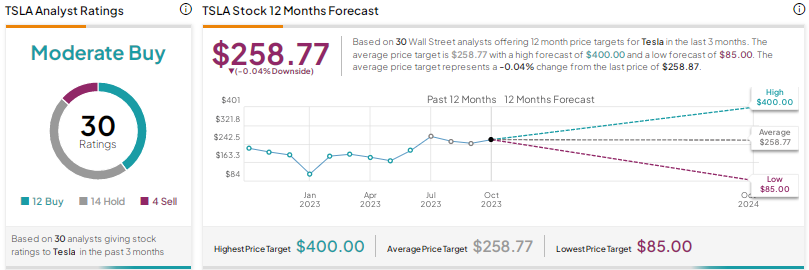

With 12 Buys, 14 Holds, and four Sells, Wall Street has a Moderate Buy consensus rating on Tesla stock. The average price target of $258.77 implies that shares could be range-bound from current levels.