Tesla (NASDAQ:TSLA) has slashed Model Y production by at least a “double-digit percentage” at its Shanghai plant since March, according to a Reuters report. The EV major is facing declining demand for its cars in China, its second-biggest market for EVs outside the U.S.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Tesla’s Production Data

According to the report, Tesla’s Shanghai plant, its biggest manufacturing hub, plans to reduce its Model Y output by at least 20% during the period from March to June.

Recently, production data from the China Association of Automobile Manufacturers (CAAM) showed Model Y output in China was 49,498 units in March and 36,610 in April, down 17.7% and 33% year-over-year, respectively.

Furthermore, Tesla produced 287,359 Model Y and Model 3 cars in China in the first four months of this year, a 5% decline compared to the same period last year, despite a 10% increase in the production output of Model 3, according to CAAM data.

It is still unclear whether the company’s production cut will continue in the second half of this year.

Tesla in China

Tesla is facing rising competition in China as consumers are moving to better models from local Chinese EV players like XPeng (NYSE:XPEV). However, the company is still looking to sell between 600,000 and 700,000 cars in China this year.

In April, Tesla reduced the prices of its Model Y cars in China to their lowest level and offered zero-interest financing for Model 3 to boost sales. Tesla’s market share in China’s electric vehicle market fell to 6.8% in the first four months of this year from 7.8% in the same period last year, when it sold 603,664 cars.

Is Tesla a Buy, Sell, or Hold?

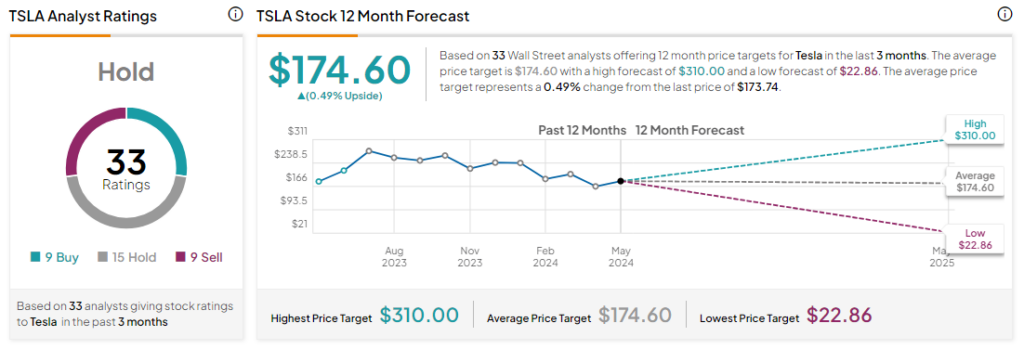

Analysts remain sidelined about TSLA stock, with a Hold consensus rating based on nine Buys, 15 Holds, and nine Sells. Year-to-date, TSLA has declined by more than 25%, and the average TSLA price target of $174.60 implies an upside potential of 0.5% from current levels.