It’s been a strange few years for automakers of every stripe, whether they be electric vehicle stocks like Tesla (NASDAQ:TSLA), or major legacy automakers like Ford (NYSE:F), General Motors (NYSE:GM), or Stellantis (NYSE:STLA). And now, as those same legacy automakers face a potential labor strike, Tesla can quietly cruise on forward, gaining ground and market share while the legacy makers fight unions.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Negotiations between the United Auto Workers and the main legacy automakers have stalled, making a strike on September 14 seem all the more likely. Worse yet for automakers, Canada’s equivalent of the UAW, Unifor, has also authorized strikes, which will ultimately hurt the legacy makers that much more.

It’s fairly easy to see why negotiations have stalled; the UAW’s demands start with a 46% pay hike over the next four years, as well as a 32-hour work week—pay, however, would remain for the equivalent of a 40-hour week—healthcare for retirees, bigger pensions, and more. Such largess would increase the auto makers’ expenses substantially, though the UAW asserts that the profits the legacy makers have brought in would more than cover the costs associated with the UAW’s contract. Meanwhile, Tesla doesn’t seem to have such problems. Though if the UAW wins, it’s easy to wonder how long before everyone else wants a deal that sweet.

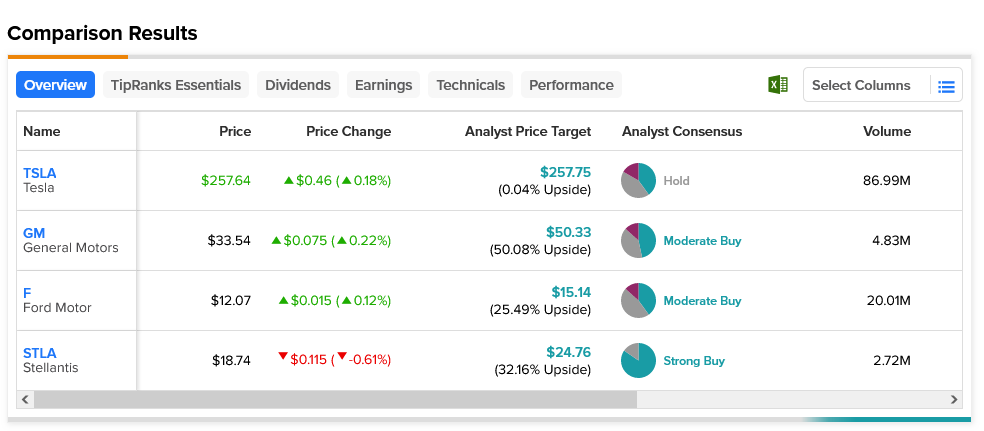

Turning to Wall Street, Tesla has the smallest upside potential out of the aforementioned stocks. With an average price target of $257.75, it’s fairly valued as far as analysts are concerned. Meanwhile, analysts expect the most from General Motors, as its $50.33 average price target gives it an upside potential of 50.08%.