Tesla’s (NASDAQ:TSLA) Shanghai unit has dragged Bingling Intelligent Technology, a Chinese chip designer and auto parts maker, to court over IP (Intellectual Property) infringement. Per the Shanghai Securities Journal, Tesla accused the Chinese company of violating its technology secrets and engaging in unfair competition.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tesla puts a strong emphasis on protecting its intellectual property rights to safeguard its product portfolio and market share. Notably, the Shanghai Intellectual Property Court will hear the lawsuit on October 10.

This comes when Tesla is facing intense competition in China from local players. The company announced price cuts to defend its market share and push volumes. Thanks to its efforts to push volumes, the EV (electric vehicle) giant’s China sales increased by 9.3% to 84,159 vehicles in August. Overall, Tesla generated revenue of $10.62 billion from China (accounting for about 22% of total company sales) in the first six months of 2023, compared to $8.44 billion the prior year.

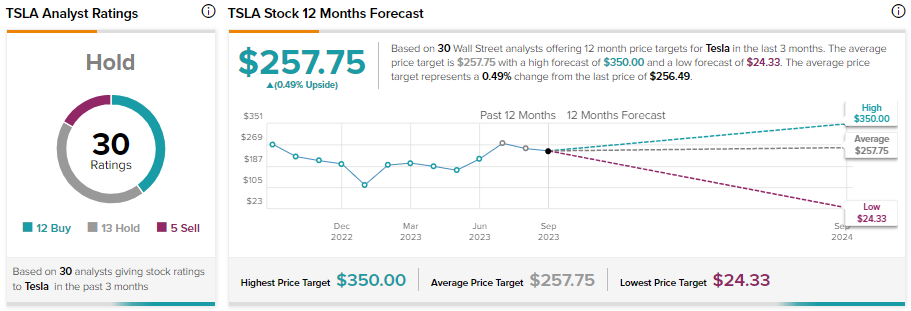

As Tesla defends its market share and IP, let’s look at Wall Street analysts’ recommendations for TSLA stock.

Is Tesla Good for the Long Term?

“Tesla is a big long-term investment,” said the company’s CEO, Elon Musk, during the Q2 conference call. The company is poised to benefit from leadership in the EV space. Moreover, its focus on cost reduction, new product development, and continuous product improvement positions it well to deliver solid growth in the long term. In addition, the acceleration of AI (Artificial Intelligence), software, and fleet-based profits will support its growth.

However, the near-term pressure on margins and demand trailing production have led Barclays analyst Dan Levy and Guggenheim analyst Ronald Jewsikow to lower their estimates for Tesla. Levy reiterated a Hold on TSLA stock on August 31. Meanwhile, in a report to investors dated August 30, Jewsikow maintained a Sell rating on Tesla shares.

Overall, TSLA stock has a Hold consensus rating, with 12 analysts recommending a Buy, 13 assigning a Hold, and five maintaining a Sell. These analysts’ average price target of $257.75 is close to its closing price on September 5.