Tesla’s (NASDAQ: TSLA) China-made vehicles declined by 12.85% sequentially as the EV major delivered 62,493 vehicles in November while its Shanghai plant exported 37,798 vehicles, according to data from China’s Passenger Car Association (CPCA).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Tesla usually produces cars for export in the first half and cars for local delivery in the second half of every quarter at this plant.

Overall, sales of passenger cars in China dropped year-over-year by 9.5% to 1.67 million units in the month of November, a 10.5% drop from October.

The data from the CPCA indicated that sales of pure battery electric cars and hybrids, soared 58.2% year-on-year to 598,000 units. This jump in sales was led by deliveries from local giant BYD Co. and U.S. EV giant Tesla.

Going by Tesla’s vehicle delivery numbers in China in November, the EV giant cornered a 10.45% share of the Chinese EV market in the month of November.

The Warren Buffet-backed BYD (BYDDY) delivered 230,427 units in November while Tesla’s monthly deliveries reached a record high.

The other Chinese EV majors including Li Auto (LI), NIO (NIO), and XPeng (XPEV) reported mixed delivery numbers in November.

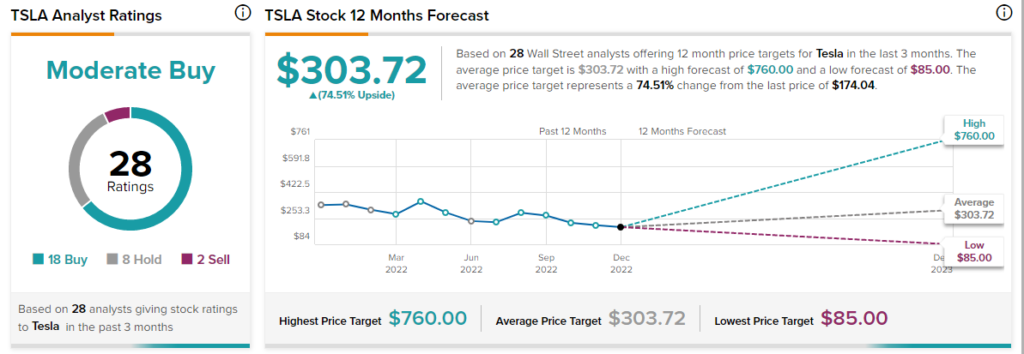

Analysts are cautiously optimistic about TSLA stock with a Moderate Buy consensus rating based on 18 Buys, eight Holds, and two Sells.