“Fortnite” proved a winner for Epic Games and its owners, Tencent (OTCMKTS:TCEHY) and Sony (NYSE:SONY). Yet the two also took a hit as Epic landed a $520 million bill to settle an outstanding case with the Federal Trade Commission (FTC). While Sony ended up down slightly in Monday’s trading, Tencent ticked up slightly.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Reports noted that the $520 million covers two separate settlements. The first featured violations of the Children’s Online Privacy Protection Act, or COPPA. Here, Epic Games allowed children to be exposed to “dangerous” content. This content included both bullying and sexual harassment, reports noted. Other reports suggest that Epic Games collected data on players under the age of 13 without their parents’ permission.

The second revolves around “deceptive design strategies” known as “dark patterns.” With these design practices, the FTC noted, Epic Games “tricked millions of players into making unintentional purchases.”

The fine is certainly a hit, but not too much of one. Reports note that “Fortnite” took in more than $9 billion just between 2018 and 2019. Continued updates ever since suggest that the company has kept bringing in cash ever since. For its part, Epic has made several updates to help address these points, including a selectable option to save payment data, a “self-service” refund program, and the ability to instantly cancel purchases.

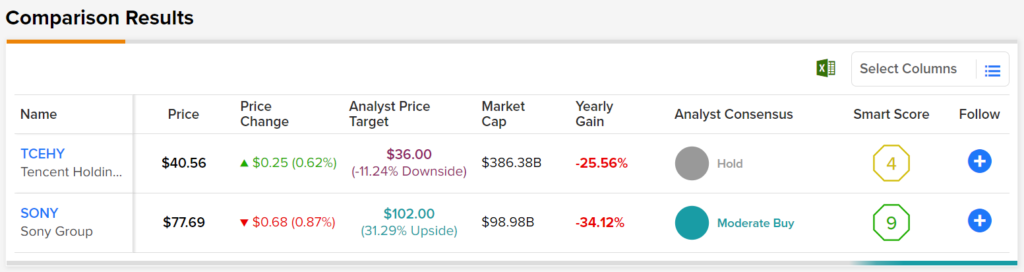

Certainly, this is an issue for Sony and Tencent, who each own a portion of Epic Games. However, since it’s one part of a much larger chain, it’s not so much of a problem for the duo. Analyst consensus currently calls Tencent a Hold and Sony a Moderate Buy. Thanks to its average price target of $36, Tencent offers an 11.24% downside risk. Sony, meanwhile, has 31.29% upside potential thanks to its average price target of $102 per share.