Tencent Music Entertainment Group announced a stock repurchase program of up to $1 billion that it intends to fund from its current cash balance. The repurchases of its Class A ordinary shares in the form of American Depositary Shares (ADS) commenced on March 29 and will be completed over the next twelve months. Shares of the China-based online music entertainment platform rose more than 7% in the pre-market session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tencent’s (TME) Chairman of the Board Mr. Tong Tao Sang said, “The Share Repurchase Program is a strong indication of the Board’s confidence in the Company’s business outlook and long-term strategy, and we believe it will ultimately benefit TME and create value for its shareholders.”

Last week, the company reported 4Q results. Total revenues of $1.28 billion (RMB8.34 billion) increased 14.3% from the year-ago period. Tencent posted earnings per ADS of $0.12 (RMB0.80), which were flat year-over-year. Results met analysts’ expectations. (See Tencent stock analysis on TipRanks)

On March 25, Needham analyst Vincent Yu reiterated a Buy rating and a price target of $25 (24.4% upside potential) on the stock.

Yu believes “TME’s dominant position, its focused strategy to drive paying-user growth, and new initiatives such as audiobooks, podcasts, and new ads programs, will drive its future growth.”

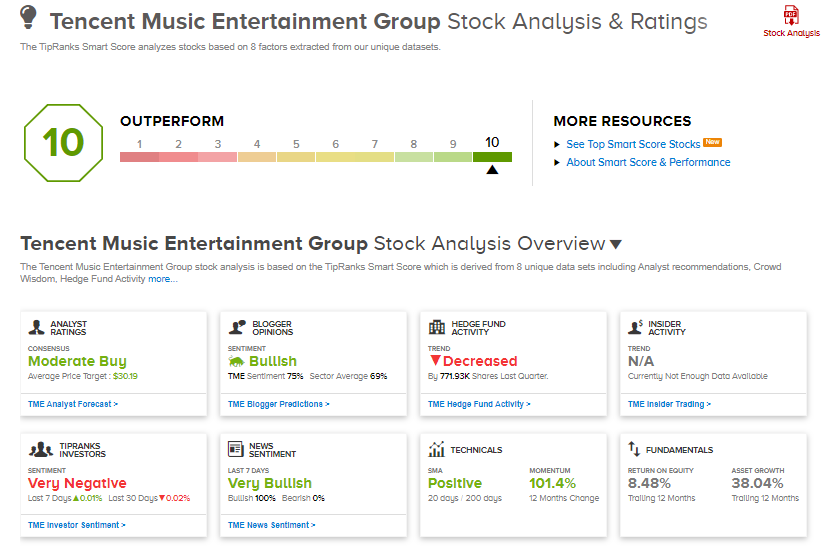

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 7 Buys, 3 Holds, and 1 Sell. The average analyst price target of $30.19 implies 50.2% upside potential to current levels. Shares have increased 35% over the past six months.

Tencent scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Catalyst Pharma To Buy Back $40M In Stock; Shares Gain Pre-Market

AutoZone To Buy Back $1.5B In Stock

Saratoga Investment Bumps Up Quarterly Dividend