Tencent Music Entertainment (TME) may have to end the type of arrangements that have bolstered its competitiveness in the music streaming business. According to a Reuters report citing confidential sources, China’s antitrust regulator plans to order Tencent Music to end exclusivity deals with music labels. TME stock fell 4.19% on Monday to close at $12.34.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Tencent Music has sought exclusivity agreements with music labels such as Warner Music Group (WMG), Sony Music Group (SONY), and Universal Music Group (UMG) to enable it to stay ahead of rivals. Now it risks losing exclusive rights to music labels at a time when it also faces growing competitive challenges from TikTok-parent ByteDance in China. (See Tencent Music stock charts on TipRanks).

In addition to the music exclusivity order, the Chinse antitrust regulator also plans to hit Tencent Music with a 500,000 yuan ($77,150) fine, according to the report. The penalty relates to the company’s failure to properly report its acquisitions of the Kuwo and Kugou apps for antitrust review. The regulator earlier considered forcing Tencent Music to sell the apps.

HSBC analyst Binnie Wong recently reiterated a Buy rating on Tencent Music stock but lowered the price target to $22 from $26. Wong’s new price target still implies 78.28% upside potential.

The analyst observes that “soft social entertainment” is facing growing near-term pressure, citing competition from short videos. Additionally, Wong notes that with Tencent Music’s Wesing platform undergoing an adjustment to make it more appealing to young users, there may be short-term fluctuations in revenue.

Consensus among analysts is a Strong Buy based on 11 Buys and 3 Holds. The average Tencent Music price target of $22.40 implies 81.52% upside potential to current levels.

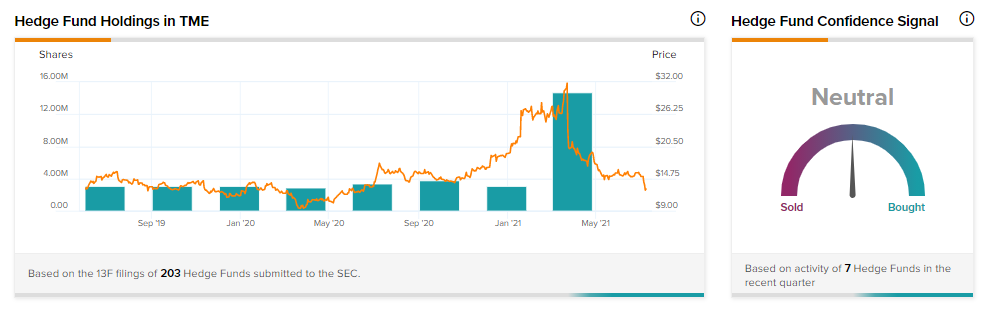

According to TipRanks’ Hedge Fund Trading Activity tool, confidence in TME is currently Neutral. The cumulative change in holdings across all seven funds that were active in the last quarter was an increase of 11.7 million shares.

Related News:

Verizon, Huawei Resolve Patent Dispute

Werner Opens New Terminal in Pennsylvania

Emerson to Sell Daniel Measurement and Control Business