U.S.-based Tempus AI (TEM) experienced a notable 9% surge in its stock price on Wednesday. This uptick occurred without any company-specific news. However, President Trump’s recent executive order promoting the use of AI to tackle pediatric, adolescent, and young adult cancers may have driven the stock higher.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tempus AI specializes in data-driven solutions for the healthcare industry, with a focus on oncology and genomics. Year-to-date, TEM stock has gained over 160%. Looking ahead, Tempus AI presents a Moderate Buy opportunity. While the company shows promising growth in the AI healthcare sector and has strategic partnerships in place, potential investors should weigh the current lack of profitability and market volatility.

What It Means for Tempus AI

Trump’s latest executive order signals a supportive environment for AI healthcare initiatives, which may directly or indirectly benefit Tempus AI’s business and stock performance.

The push for AI-driven cancer solutions could greatly expand the market for Tempus AI’s technologies. At the same time, government support for AI in healthcare may boost investor confidence and help drive the stock higher.

Additionally, the executive order could lead to new partnerships, grants, or government-backed projects, giving Tempus AI more opportunities to grow its AI healthcare solutions.

Top Analyst Raises Price Target on TEM

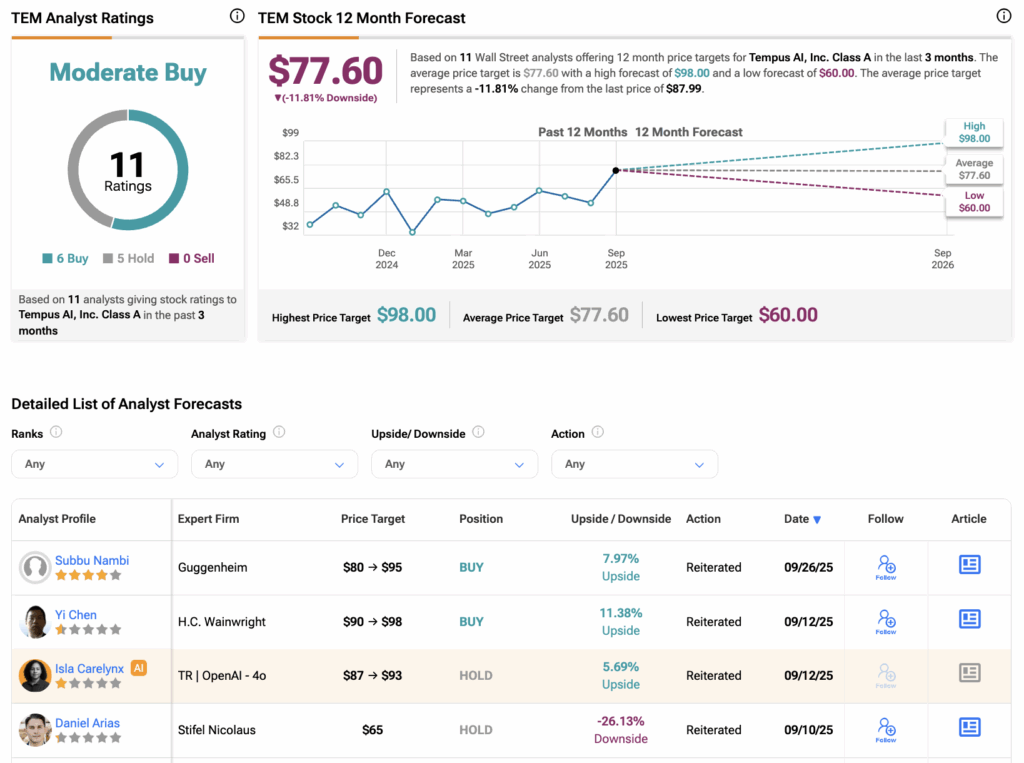

Last week, four-star-rated analyst Subbu Nambi at Guggenheim raised her price target on TEM stock from $80 to $95 while keeping her Buy rating.

The price target increase reflects Nambi’s continued optimism about Tempus AI’s oncology foundation model, developed in collaboration with AstraZeneca (AZN) and Pathos AI. She noted the model is considered “highly differentiated” in the market.

Tempus AI Drives Expansion in Oncology Solutions

Tempus AI’s oncology segment integrates genomic testing, liquid biopsies, and AI-driven diagnostics to personalize treatment decisions.

Last week, the company received FDA 510(k) clearance for the Tempus xR IVD device, designed for tumor analysis. This diagnostic tool helps drugmakers identify patients most likely to respond to cancer treatments, making clinical trials more efficient by focusing on those with the highest chance of positive outcomes. The FDA clearance could create new commercial opportunities for Tempus through partnerships with biopharma companies.

Is Tempus a Good Stock to Buy?

On TipRanks, TEM stock has received a Moderate Buy rating based on six Buy and five Hold recommendations. The Tempus AI share price forecast is $77.60, which implies a decline of 11.81% from the current level.