Tellurian (NYSEMKT:TELL) is a liquefied natural gas developer, which should put it in a good economic position. After all, from power to home heat, much of America and the world runs on natural gas. But Tellurian isn’t doing so well, and it’s down nearly 9% in Monday afternoon’s trading as some previous shakeups continue to impact the stock as a whole.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tellurian, in recent days, has seen no shortage of shakeups in its top brass. It recently moved Samik Mukherjee from Executive Vice President and President of Driftwood Assets to President of Tellurian Investments, which gives Mukherjee control of most of Tellurian’s asset development.

It’s also left Daniel Belhumeur in place as the chief figure in accountability for finance, investor relations, and several other fronts. Meanwhile, CEO Octavio Simoes is moving from the CEO slot to an “advisory role,” and board member Brooke Peterson is planning to depart the company altogether for “health reasons.”

Trouble Afoot?

That’s an awful lot of movement in a short period of time and represents an extremely volatile period for Tellurian as a whole. Yet, that’s not so much where the trouble ends, unfortunately, as where it begins. Reports note that plans to sell off the Driftwood LNG plant were stymied as no previous potential customers seemed interested in pulling the trigger.

Indeed, The Williams Companies was one of those who passed on it, noting that while it had permits and an excellent “speed to market,” its lack of “commercial contracts on the demand side” didn’t help. Throw in the fact that Simoes has only been CEO since “late last year” but is retiring in months, and that’s a further discouraging sign.

Is Tellurian a Good Stock to Buy?

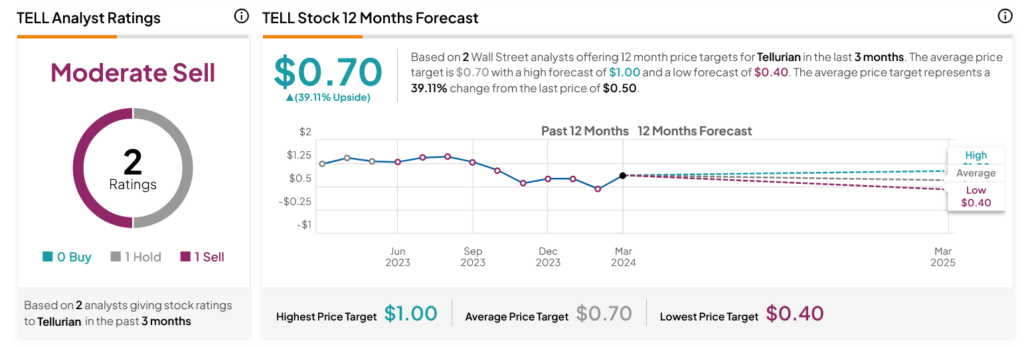

Turning to Wall Street, analysts have a Moderate Sell consensus rating on TELL stock based on one Hold and one Sell assigned in the past three months, as indicated by the graphic below. After a 53.31% loss in its share price over the past year, the average TELL price target of $0.70 per share implies 39.11% upside potential.