Shares of Canadian miner Teck Resources (TSE:TECK.B) (NYSE:TECK) slumped over 6% at the time of writing after the company reported lower-than-expected Q3 earnings. Teck Resources said lower steelmaking coal sales contributed to the Q3 revenue slump.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In particular, Teck’s EPS came in at C$0.76 per share, below the analyst consensus of C$1.06. Likewise, revenues fell 15.5% year-over-year to C$3.6 billion, almost in line with the consensus expectation of C$3.66 billion. The company stated that a drop in Highland Valley copper sales volumes also hurt its business.

Following its recent report, Teck reduced its 2023 forecast for its copper and steelmaking coal business. Notably, the company plans to produce 320K-365K tons of copper this year, down from 330K-375K tons, citing a geotechnical incident at Highland Valley Copper. Furthermore, Teck dropped its FY 2023 production forecast for steelmaking coal to 23M-23.5M tons, down from 24M-26M tons.

For its QB2 copper project in Chile, the firm raised its capital cost range from $8 billion-$8.2 billion to $8.6 billion-$8.8 billion, noting that efforts are still being made to reduce risks and costs. Additionally, the company stated that it anticipates yearly output for QB2 to be at the lower end of its 2023 projection.

The Canadian miner expects the operational slump to persist and, thus, cut its production targets for the second straight quarter. Elsewhere, the company also cut its molybdenum production guidance as it expects a delay in the construction of the mineral’s production facility.

Is Teck Resources Stock a Good Buy?

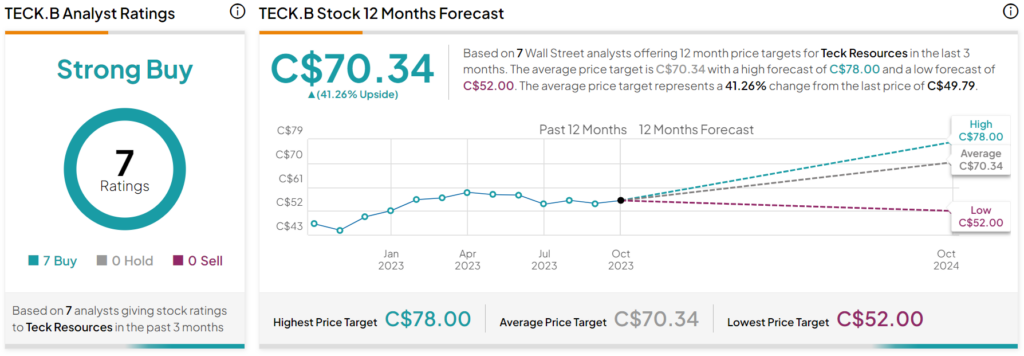

Turning to Wall Street, analysts have a Strong Buy consensus rating on TECK stock based on seven Buys assigned in the past three months, as indicated by the graphic above. Furthermore, the average TECK price target of C$70.34 per share implies 41.26% upside potential.