It was just a week ago when Teck Resources (NYSE:TECK) managed to impress its shareholders sufficiently to push shares up 18% by turning down an offer from Glencore (OTC:GLCNF). Now, Teck gained once more in Tuesday’s trading after Glencore moved to sweeten the offer.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Interestingly, analysts expected this particular sweetening to take place. Jefferies analyst Christopher LaFemina noted that a “cash kicker” would ultimately be called for to get Teck’s interest. Now, that’s just what’s happened. Glencore ultimately proposed adding a cash element to its earlier offer, which was all-stock. The latest proposal now calls for Teck shareholders to land not only 24% of the company that would arise from the deal but also split an $8.2 billion pot of cash.

The move would actually go a long way toward fixing one of the deal’s primary problems: issues with Teck’s Environmental, Social, and Governance (ESG) policies. The cash payment would keep Teck out of Glencore’s thermal coal business. That was a major cause of Teck’s initial rejection of Glencore’s offer. But while Teck brass called the original Glencore offer a “non-starter,” there’s less word on what they think of the revised offer.

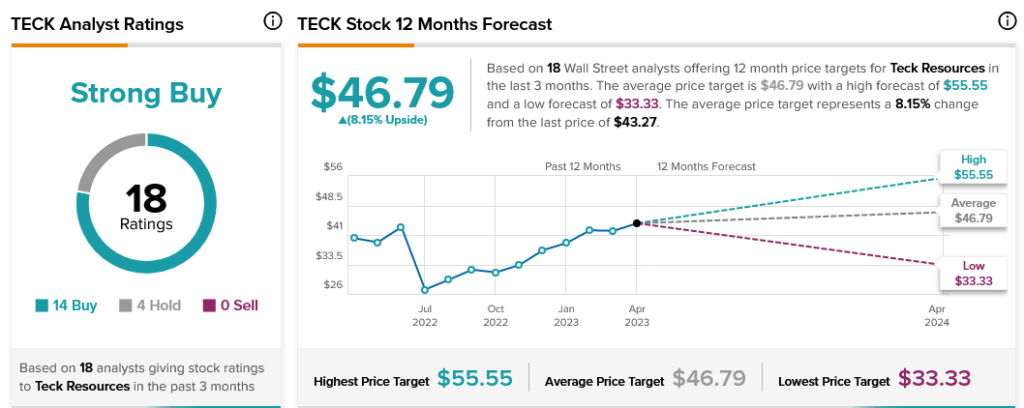

Regardless, it’s clear that analysts are all in on buying TECK stock as it’s considered a Strong Buy by analyst consensus, with 14 Buy recommendations against just four Holds. In addition, its average share price target of $46.79 gives it 8.15% upside potential.