Digital ecosystems are a major part of many businesses’ operations, and the notion of keeping them open should appeal to many. Especially those who believe they have a competitive edge over their cohorts in the field. With that in mind, it’s little wonder that tech stocks Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), Meta Platforms (NASDAQ:META) and Qualcomm (NASDAQ:QCOM) got together to push for open digital ecosystems. The move proved only mildly interesting to shareholders, however, as each was up fractionally in Wednesday morning’s trading session.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The new group calls itself the Coalition for Open Digital Ecosystems, or CODE. CODE has a particular target in mind for its efforts: the European Union. Specifically, CODE wants to address some newly minted tech rules that might ultimately become new legislation and get in before those rules become laws and potentially crimp CODE’s operations in the region. CODE, for its part, wants to push for more “open platforms” and systems that offer more opportunities for growth and development.

Attempting to Build the Future

There are others involved in CODE as well, including a UK electronics maker known as Nothing and the German messaging company Wire. But all of them are together for one key reason: to attempt to build a future in which they’re still relevant. That may sound overly facile and self-serving, but it’s likely the thrust of the argument: these businesses don’t want laws made that will ultimately hinder or potentially even shut down their operations. As a result, they’re looking to be what amounts to a Europe-wide lobbying group to try and keep their seats at the table. Reasonable enough and certainly good for shareholders, though some purists might believe they should stay out of the law.

Which Tech Stocks are a Good Buy Right Now?

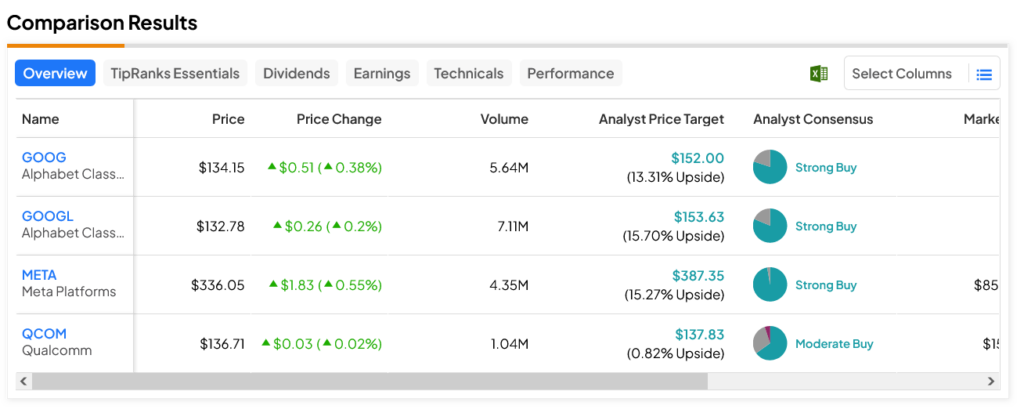

Turning to Wall Street, GOOGL stock is the leader right now. This Strong Buy-rated stock offers investors a 15.7% upside potential against its $153.63 average price target. Meanwhile, Moderate Buy-rated QCOM stock is the laggard, as its $137.83 average price target means only a 0.82% upside potential.