Some investors are starting to pull back from tech stocks after this year’s big rally. Indeed, hedge funds recently sold off tech shares at the fastest rate since August and moved their money into value sectors, such as banks, according to Goldman Sachs (GS). At the same time, options traders aren’t placing big bets over the next six months either. However, Bank of America (BAC) says that this cautious mood has made it cheaper for investors to use options if they still believe tech stocks will keep rising.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Interestingly, Bank of America’s derivatives team does believe that the rally in AI-related tech stocks still has more room to grow. As a result, they suggest using a six-month call spread on the Invesco QQQ ETF (QQQ), which tracks big tech names. If QQQ rises at least 9.4% by late March, the trade could return up to seven times its cost. In addition, Strategist Arjun Goyal explained that past asset bubbles often kept growing even after warning signs appeared, and this AI-driven rally might be similar.

In fact, Bank of America’s research shows that stock bubbles in the past gained an average of 244% from their lowest to highest points, and the current “Magnificent Seven” stocks have only risen 223% so far. Still, not everyone shares BofA’s optimism. Notably, the cost to hedge against a 10% drop in QQQ has been rising, while the cost to bet on a big rally hasn’t, which suggests that traders expect small moves in either direction. Meanwhile, hedge fund manager David Einhorn recently warned that the massive spending on AI infrastructure could lead to capital destruction.

Is QQQ Stock a Good Buy?

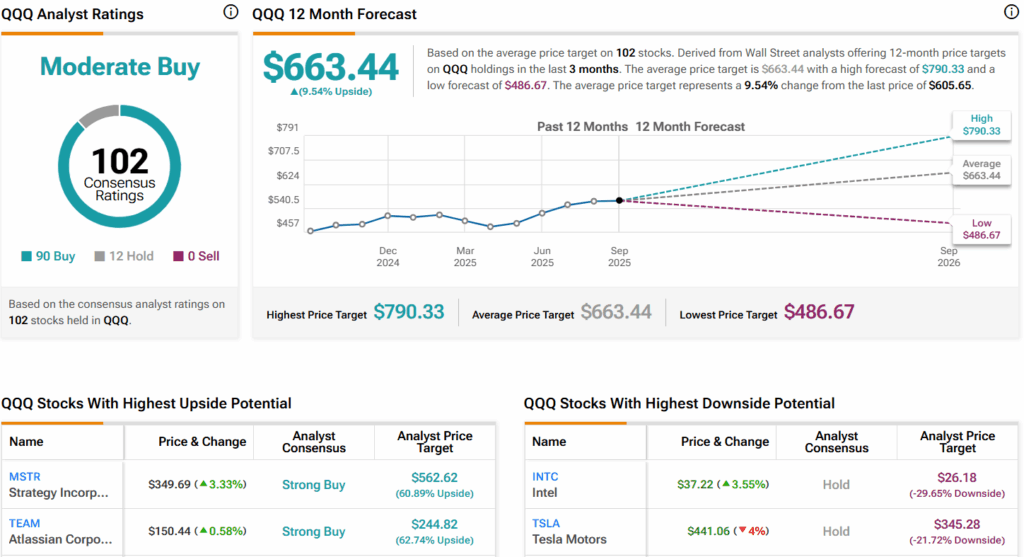

Turning to Wall Street, analysts have a Moderate Buy consensus rating on QQQ stock based on 90 Buys, 12 Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average QQQ price target of $663.44 per share implies 9.5% upside potential.