Shares of Toronto-Dominion Bank (TD) rose 4% in early trading Thursday after Canada’s largest bank posted better-than-expected results in its third quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The bank also raised its quarterly dividend by 13%. (See Analysts’ Top Stocks on TipRanks)

Profits & Revenue

Profit came in at C$3.78 billion (C$2.04 per diluted share) for Q4 2021, down 26.5% from a profit of C$5.14 billion (C$2.80 per share) in Q4 2020. On an adjusted basis, TD earned C$2.09 per diluted share in its latest quarter, down from C$1.60 per diluted share in the prior-year quarter. The consensus was for adjusted earnings of C$1.94 per share.

Revenue totaled C$10.94 billion in the quarter ended October 31, down 7.6% from C$11.84 billion a year ago. Analysts expected revenue of C$10.41 billion.

TD’s Canadian Retail operations net income soared 16.7% year-over-year to C$2.1 billion. Its U.S. Retail business earned nearly C$1.4. billion, up 60.7% from a year ago.

The bank’s Wholesale Banking unit posted a 13.6% decrease in net income to C$420 million. TD’s Common Equity Tier 1 Capital ratio was 15.2% in the fourth quarter, compared to 13.1% in the prior-year quarter.

President Commentary

TD Bank Group president and CEO Bharat Masranai said, “In 2021, we demonstrated the value of our diversified business model, delivering continued growth and shareholder returns while supporting millions of households and businesses through a second year of COVID-19-related disruption and uncertainty.

“Forward-focused investments in new capabilities and innovation drove higher loan and deposit volumes in our retail businesses, increased revenues in Wealth and Insurance, and strong results in our Wholesale business in the fourth quarter of 2021. We ended the year in a position of strength, with a growing base of customers across highly competitive and diversified businesses and a robust capital position, enabling us to increase our dividend and providing us with a strong foundation upon which to continue building our business in 2022.”

Wall Street’s Take

On November 30, BMO Capital analyst Sohrab Movahedi reiterated a Hold rating on TD and a price target of C$94. This implies 1.7% downside potential.

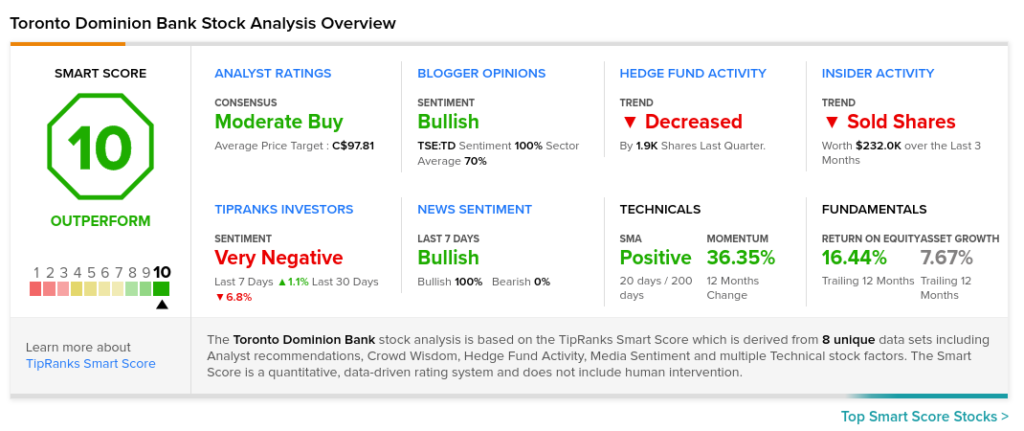

Overall, TD scores a Moderate Buy rating among Wall Street analysts based on four Buys and four Holds. The average Toronto-Dominion Bank price target of C$97.81 implies 2.3% upside potential to current levels.

TipRanks’ Smart Score

TD scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform the overall market.

Related News:

TD Q4 Earnings Preview: What to Expect

TD Named North America’s Best Consumer Digital Bank

National Bank Q4 Profit Misses Estimates, Dividend Raised