U.S. President Donald Trump’s tariffs will cost global businesses upwards of $1.2 trillion this year, with most of that cost being passed along to consumers, says S&P Global (SPGI) in a new report.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The financial information company adds that its estimate of $1.2 trillion is likely to be “conservative.” The cost of tariffs on businesses around the world was calculated based on information provided by 15,000 sell-side analysts across 9,000 companies that contribute to S&P Global and its research.

“Tariffs and trade barriers act as taxes on supply chains and divert cash to governments; logistics delays and freight costs compound the effect,” writes S&P Global in its report. The firm stresses that the majority of the costs from tariffs are being passed onto consumers in the form of higher prices.

High Stakes

Trump in April slapped a 10% tariff on all goods entering the U.S. and placed additional tariffs on dozens of other countries and industries. While U.S. government officials insist that exporters will bear the greater share of the import duties, S&P says that is only partly true.

According to S&P Global, one-third of tariff costs will be borne by companies, with the rest falling directly on consumers. “Consumers are paying more for less, suggesting that this two-thirds share represents a lower bound on their true burden,” writes the firm in its newest report.

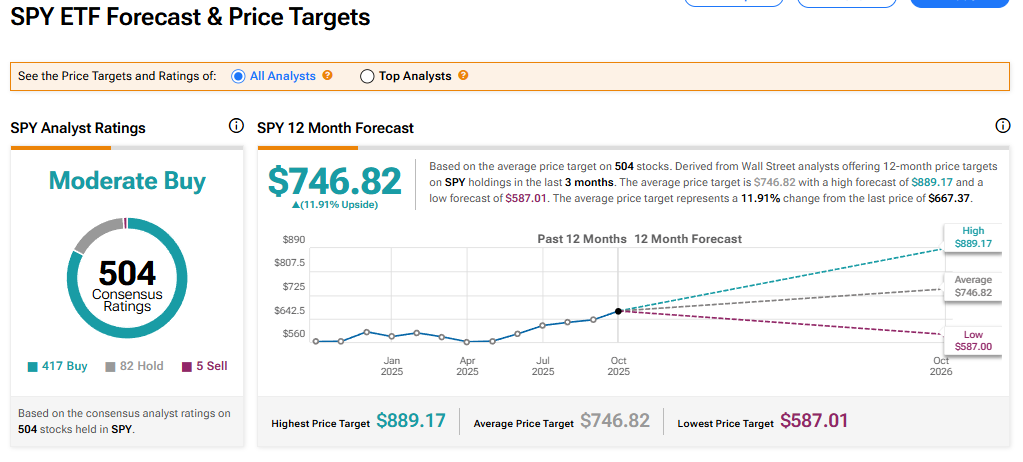

Is the SPDR S&P 500 ETF Trust a Buy?

The SPDR S&P 500 ETF Trust (SPY) currently has a Moderate Buy rating among 504 Wall Street analysts. That rating is based on 417 Buy, 82 Hold, and five Sell recommendations issued in the last three months. The average SPY price target of $746.82 implies 11.91% upside from current levels.