Bad news for toymakers, as Santa’s sleigh looks like it will be a little less full than normal. Retail giant Target (TGT) offered up a preview of the coming holiday shopping season based on its toy order, and the news is not looking bright. Shareholders, though, seem unconcerned as shares are up fractionally in Wednesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Basically, the word out of Target—and also, out of Walmart (WMT)—is that holiday sales estimates are represented by order size. If the stores place big orders with toy makers, then they expect a big Christmas shopping season. Smaller orders, meanwhile, mean lower expectations. And right now, the expectations look pretty low as third-quarter orders seem pretty light.

Reports note that Target’s order size for the third quarter from manufacturer Mattel (MAT) was significantly smaller than normal, with Mattel’s CEO Ynon Kreiz pointing out “…industry-wide shifts in retailer ordering patterns.” This means that Target is looking to place orders more on an as-needed basis rather than stocking up ahead of the holiday. That in turn suggests diminished sales expectations for the holiday shopping season, and a potentially gloomy Christmas ahead.

Time to Salt the Parking Lot

Meanwhile, another story emerged that teaches us all the value of keeping the parking lot in good condition. A Target shopper walking into the building slipped and fell in the parking lot. At the time, she was holding her child. And when she fell…she broke four bones. That is a downright disaster, but a jury handed over $11.3 million in a lawsuit after the event, so there is some consolation.

Since she fell in Winter Garden, Florida, it was not the snow and ice that got her, but rather, a seam left exposed between the curb and the asphalt of the parking lot. The result was a “…notable and abrupt change in elevation,” which in turn proved a violation of several building codes, reports noted. Interestingly, Target offered a settlement of $250,000, which she turned down, and ended up with an eight-figure payout after a jury found Target “90% at fault.”

Is Target Stock a Good Buy?

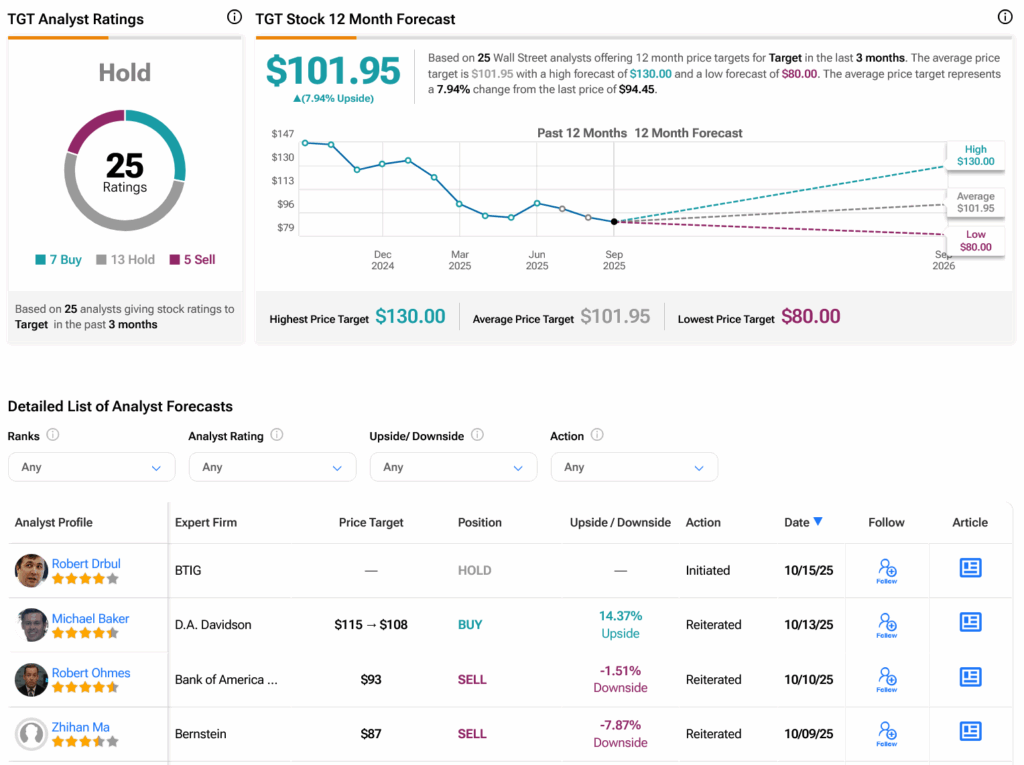

Turning to Wall Street, analysts have a Hold consensus rating on TGT stock based on seven Buys, 13 Holds and five Sells assigned in the past three months, as indicated by the graphic below. After a 36.24% loss in its share price over the past year, the average TGT price target of $101.95 per share implies 7.94% upside potential.