Target (NYSE:TGT) is recalling about 4.9 million units of its Threshold-brand candles that were sold exclusively at the company’s stores and online. These candles were sold in the period between August 2019 and March 2023. It is important to note that Target has recalled several products in 2023 so far. These recalls might raise customer worries and weaken the already waning market for the company’s products.

According to the U.S. Consumer Product Safety Commission, 137 glass jars broke or cracked while being used, prompting complaints. Additionally, six injuries were recorded, including serious burns and lacerations.

The company has advised an urgent return and requested that clients request a refund. The cost of each candle ranged from $3 to $20.

These recalls seem to impact the company’s top- and bottom-line numbers to some extent. In its first-quarter results reported on May 17, the company reported just a marginal 0.6% year-over-year growth in revenue to $25.32 billion. Moreover, traffic grew by 0.9% in comparison to 3.9% in the last year’s quarter.

Analysts Weigh In

Following the earnings, nine analysts reiterated a Buy rating on TGT stock while two maintained their Hold rating.

Among the bullish analysts, analyst Bradley Thomas from KeyBanc said that the company’s second-quarter guidance reflects slowing consumer discretionary spending trends. Nevertheless, Target’s cost-control measures remain encouraging.

Will TGT Stock Go Up?

Turning to Wall Street, TGT stock is a Moderate Buy based on 14 Buys and 10 Hold ratings. The average Target stock price target is $180.92, implying 18.8% upside potential.

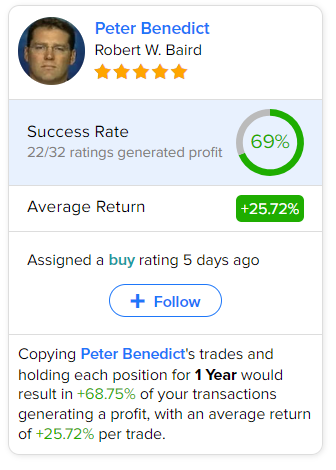

As per TipRanks data, the most accurate analyst for Target is Robert W. Baird analyst Peter Benedict. Following Benedict’s advice, each trade for one year could result in 69% of your transactions generating a profit, with an average return of 25.72% per trade. Importantly, the analyst reaffirmed his Buy rating on TGT stock about five days ago.