Retail giant Target (NYSE:TGT) has always been known for being a step up from Walmart (NYSE:WMT). Now, it’s known for something different: slightly less convenient self-checkout systems. Going forward, customers will only be allowed to check out 10 items at a time through a self-checkout system. The change will start up on Sunday, and should take effect at most of Target’s U.S. stores. The move struck a minor chord with investors, though, who sent shares up fractionally in Friday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As for why the change took place, Target didn’t specifically cite shoplifting in any remarks, but it did note previously that theft was on the rise, and self-checkout lanes have been known to facilitate theft. Not everyone, however, is so certain.

Pushing into Advertising

Meanwhile, Target is taking a page from Macy’s (NYSE:M) book and stepping up its work in advertising. Target’s subsidiary, Roundel, recently brought out the Roundel Media Studio, which allows brands to buy ads directly from Roundel reps. The ads are displayed on the Target website and app and can be sold according to a wide range of keywords. Roundel Media Studio is designed to be a fast and easy way for Target to sell advertising space on its website, where shoppers are already clearly interested in making purchases.

What Is the Prediction for Target Stock?

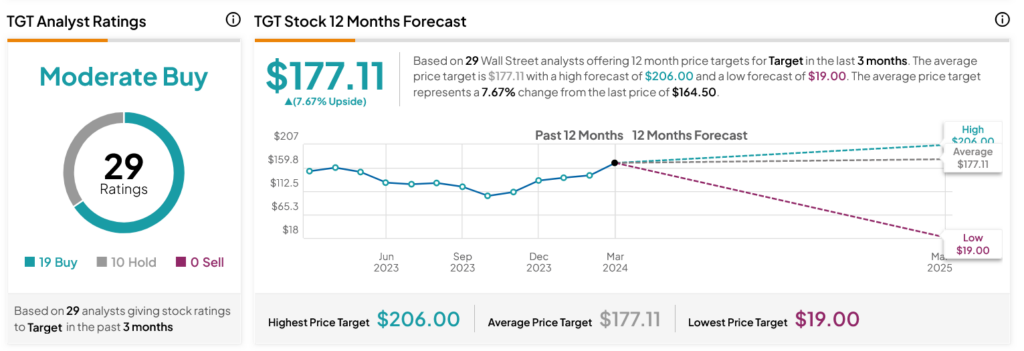

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TGT stock based on 19 Buys and 10 Holds assigned in the past three months, as indicated by the graphic below. After a 4.43% rally in its share price over the past year, the average TGT price target of $177.11 per share implies 7.67% upside potential.