Luxury fashion holding company Tapestry (NYSE:TPR) wants to add more brands to its portfolio through acquisitions. According to the Wall Street Journal, the company, which owns iconic brands like Coach, Kate Spade New York, and Stuart Weitzman, may acquire Capri Holdings (NYSE:CPRI).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Capri Holdings owns fashion brands such as Versace, Jimmy Choo, and Michael Kors. Incorporating these brands into its portfolio will strengthen Tapestry’s competitive positioning against its European peers.

Regarding the timing, the report highlighted that an announcement of the deal could potentially occur as early as today. It’s worth noting that Capri Holdings was initially scheduled to report its first quarter Fiscal 2024 financials on August 8. However, the company rescheduled it for August 10. Meanwhile, Tapestry plans to report its fourth-quarter financials on August 17.

Ahead of their quarterly reports, Goldman Sachs analyst Brooke Roach reiterated a Buy rating on TPR and CPRI stocks. On July 31, the analysts said, “We remain Buy rated on both CPRI and TPR but lower our estimates and target price for CPRI.” Against this backdrop, let’s delve into the Street’s consensus estimates on these stocks.

Here’s What Capri’s Consensus Estimates Indicate

Analysts expect Capri Holdings to report revenue of $1.2 billion in Q1, reflecting a sequential and year-over-year decline. The softness in consumer spending in the Americas and weakness in the wholesale segment are likely to weigh on its top line.

The decline in Capri Holdings’ top line will likely weigh on its bottom line. Analysts expect Capri Holdings to post earnings of $0.71 a share in Q1, compared to earnings of $1.5 a share in the prior-year period.

A Closer Look at Tapestry’s Consensus Estimates

Wall Street analysts expect Tapestry to report revenues of $1.66 billion in Q4, compared to $1.63 billion in the prior-year quarter. The company’s top line is likely to benefit from higher sales in Greater China and Japan. However, weakness in North America could remain a drag.

Thanks to the improved sales, analysts expect the company to post earnings of $0.97 a share, up from an EPS of $0.78 per share in the prior-year quarter.

As consensus estimates show that Tapestry’s top and bottom lines will improve while Capri Holdings’ financials will likely decline, let’s look at analysts’ recommendations on these stocks.

Is Capri a Good Stock to Buy?

Analysts are cautiously optimistic about Capri Holdings stock ahead of Q2 earnings. CPRI stock has a Moderate Buy consensus rating on TipRanks based on nine Buy and seven Hold recommendations. Analysts’ average price target of $50.56 implies 46.08% upside potential from current levels.

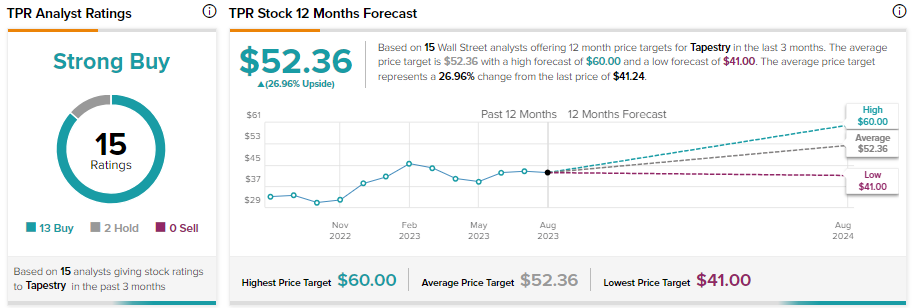

What is the Price Target for Tapestry Stock?

Analysts have a 12-month price target of $52.36 on Tapestry stock, implying 26.96% upside potential from current levels. Further, the stock has a Strong Buy consensus rating on TipRanks, reflecting 13 Buy and two Hold recommendations.