Without question, now that “Starfield” has launched, the biggest news in gaming right now is the upcoming eventual launch of “Grand Theft Auto 6.” And Take-Two Entertainment (NASDAQ:TTWO), the company behind it, is laughing all the way to the bank. Shares were up over 2.5% as analysts expect big things.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Deutsche Bank, via analyst Ben Soff, upgraded Take-Two from Hold to Buy as “Grand Theft Auto 6” will almost certainly be a big seller when it emerges. Just the trailer alone—expected out in “early December” at last report—will spark investor interest and get cash funneled into Take-Two’s coffers as investors look to buy a piece of the next big release. Further good news came as Soff pointed out that Take-Two has a “robust development pipeline,” featuring 14 “core titles” being prepared for release in the 2025 and 2026 Fiscal Years.

Take-Two is Planning for the Future

We know from Deutsche Bank’s assertions that Take-Two’s development pipeline is looking good, but that’s based largely on two years worth of development projects. That’s certainly good enough for investors to make some cash. But is there a reason to stick around past that point? Indeed, there might be: CEO of Take-Two Strauss Zelnick pointed out that, increasingly, generative AI is playing a bigger part in gaming. When asked about generative AI in NPCs—non-player characters—Zelnick noted that “…everyone’s working on that.” The notion of AI-driven NPCs in a “Grand Theft Auto” game should be downright thrilling to players, which will likely only drive sales harder.

What is the Target Price for Take-Two Interactive Stock?

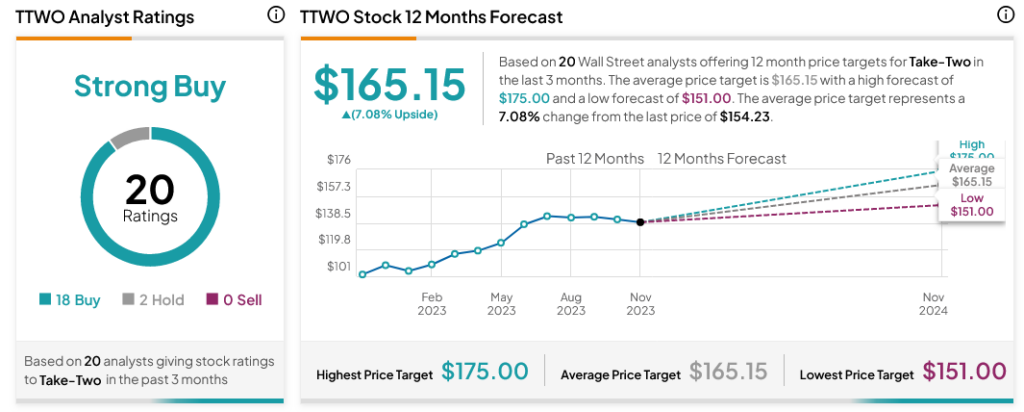

Turning to Wall Street, analysts have a Strong Buy consensus rating on TTWO stock based on 18 Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 52.61% rally in its share price over the past year, the average TTWO price target of $165.15 per share implies 7.08% upside potential.