CoreWeave (NASDAQ:CRWV) burst onto the AI scene earlier this year with the largest U.S. tech IPO in years. The GPU-as-a-Service company captured the excitement of the AI era, and its share price surged skyward in its first few months as a public company.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The market has been singing a different tune over the past few months, however, and CRWV has seen its share price drop almost 35% since reaching a mid-June peak. Investors seemed to be a bit worried by the company’s lack of profits, a high debt-to-equity ratio of 3.81, and an EPS GAAP miss of -$0.11 during Q2 2025.

Recently, however, things have been looking up. Just this month, CRWV inked a $6.3 billion order with Nvidia – who is also an investor in CoreWeave – whereby Nvidia has agreed to purchase any unsold capacity. A few days later, CRWV also signed a contract extension with OpenAI that could be worth up to $6.5 billion, bumping up the total value of the contract to $22.4 billion.

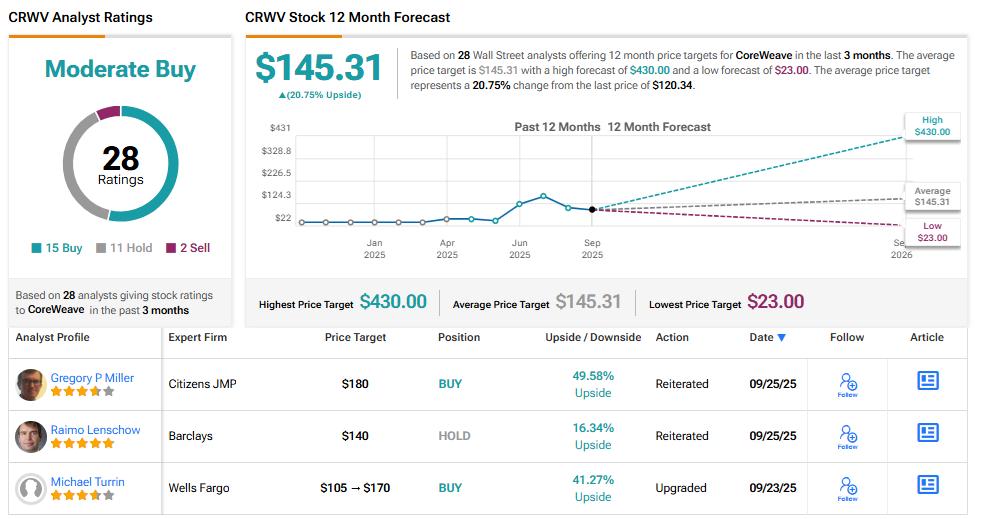

A number of Wall Street analysts have increased their price targets over the past week and a half, no doubt encouraged by these major contracts and the continued appetite for GPU capacity among the hyperscalers.

While recognizing the merits of CRWV, top investor Daniel Sparks isn’t certain the exuberance is fully justified.

“The business is scaling fast, but it remains capital intensive and reliant on a handful of customers. The risk-reward at the current price, therefore, deserves a sober look,” explains the 5-star investor, who is among the very top 1% of stock pros covered by TipRanks.

Sparks readily acknowledges CRWV’s growing numbers, noting that the company’s Q2 2025 revenues of $1.21 billion was a marked increase from $395 million during Q2 of the previous year. Still, the investor also points out that the company absorbed $291 billion in net losses, with $267 million in net interest expenses.

Indeed, the risks for the newly public company are real indeed. Sparks cites GAAP operating income in Q2 2025 of only $19 million, as stock-based compensation and interest expenses hampered earnings. Meanwhile, over 77% of its revenues came from just two customers, leaving the company highly exposed to rapid swings in sentiment if things shift.

For Sparks, the current valuation reflect “near-flawless expansion,” making this one a bit iffy for most investors.

“Staying on the sidelines and looking for something less speculative – or for a better entry point if expectations cool – may be the smarter move,” sums up Sparks. (To watch Daniel Sparks’ track record, click here)

There’s a range of views among Wall Street, though its 15 Buys, 11 Holds, and 2 Sells combine to give CRWV a consensus Moderate Buy rating. Its 12-month average price target of $145.31 imply gains north of 20% in the year ahead. (See CRWV stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.