Taiwan Semiconductor (NYSE:TSM) reported revenues of NT$156.40 billion in June, representing a decline of 11.4% month-over-month and 11.1% year-over-year. The chipmaker’s lower revenues can be attributed to a slowdown in demand for client PCs and smartphones.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The latest monthly report marks the fourth consecutive decline in revenues compared to the prior year period. Additionally, TSM’s revenues for January through June totaled NT$989.5 billion, a decrease of 3.5% year-over-year.

It is noteworthy that in mid-April, TSMC had guided for a 16% fall in Q2 sales. The company said its clients are grappling with excess inventory due to weakened macroeconomic conditions, which in turn led to soft end-market demand.

Nevertheless, TSM expects the scenario to improve in the second half of 2023, backed by new product launches by some of its key customers, including Apple (AAPL), Nvidia (NVDA), and Broadcom (AVGO).

What is the Price Target of TSM Stock?

According to the analyst consensus, TSM is a Strong Buy based on five unanimous Buy ratings. The average Taiwan Semi stock price target is $121.67, implying 21.39% upside potential.

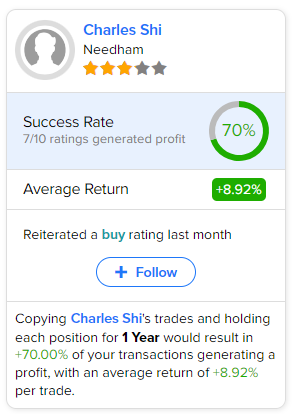

Investors looking for TSM’s most accurate and profitable analyst could follow Needham analyst Charles Shi. Copying the analyst’s trades on this stock and holding each position for one year could result in 70% of your transactions generating a profit, with an average return of 8.92% per trade.