Chip giant Taiwan Semiconductor Manufacturing Company (NYSE:TSM) reported better-than-expected second-quarter Fiscal 2023 results. Diluted earnings came in at $1.14 per ADR unit, beating consensus estimates by $0.06. Similarly, revenues of $15.68 billion outperformed analysts’ estimates by approximately $300 million.

To be precise, Q2 revenues plunged 13.7% year-over-year owing to the continued slowdown in demand for consumer electronics worldwide. Further, the company’s earnings declined significantly from the prior-year period’s figure of $1.55 per ADR.

A slump in demand for smartphones, laptops, and PCs has bloated the inventory levels at retailers, thereby curbing demand for TSMC’s chips. This has eventually lowered the price of the company’s chips. TSMC’s largest customer, Apple (NASDAQ:AAPL), is also witnessing an overall decline in demand for its iPhones, iPads, and Mac notebooks, which is greatly impacting TSMC’s performance.

What is the Price Target for TSM Stock?

On TipRanks, the average Taiwan Semi price target of $124 implies 20.3% upside potential from current levels. TSM stock commands a Strong Buy consensus rating based on four Buys and one Hold rating. Meanwhile, TSMC has gained 40.3% year-to-date.

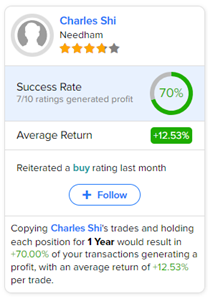

Moreover, investors looking for the most accurate and most profitable analyst for TSM could follow Needham analyst Charles Shi. Copying his trades on this stock and holding each position for one year could result in 70% of your transactions generating a profit, with an average return of 12.53% per trade.