Taiwan Semiconductor Mfg. Co. (NYSE: TSM) declined in pre-market trading on Monday after the semiconductor giant indicated that it was not averse to macroeconomic headwinds and reported its first drop in monthly revenue in almost four years. The chip company reported revenues in March of NT$145.41 billion, a decline of 10.9% month-over-month and a drop of 15.4% year-over-year.

TSM’s revenues for January through March totaled NT$508.63 billion, up by 3.6% year-over-year.

According to a Reuters report, TSM is also “communicating with the U.S. government about the CHIPS ACT guidance” and Taiwan and its chip industry were working on understanding better the CHIP Act. Taiwan Semi is currently building a plant in Arizona to diversify its manufacturing facilities and hopes to receive funding from the CHIPS Act legislation.

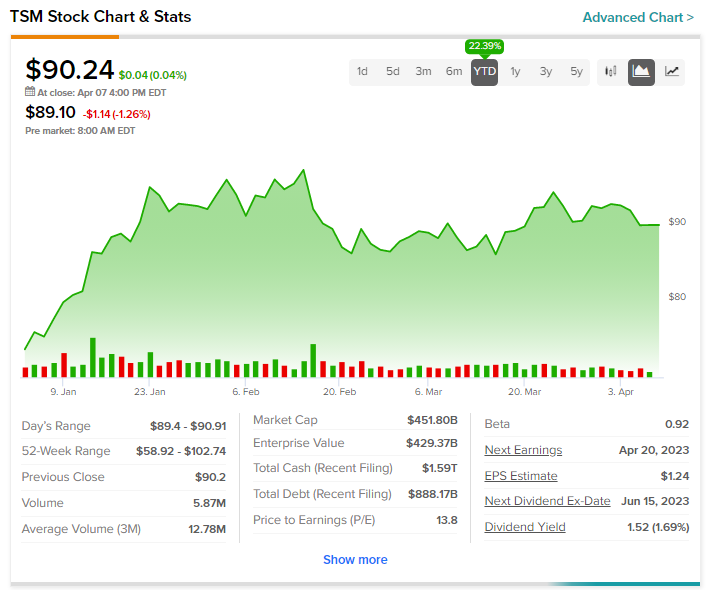

Year-to-date, TSM stock has jumped more than 22%.