American wireless network operator T-Mobile US (NASDAQ:TMUS) is switching customers, without their agreement, from older postpaid plans to the latest upgraded pricey 5G plans. Those unwilling to upgrade must opt out of the service, the company said. As per a Wall Street Journal report, the new plans will cost an additional $5 per month per line.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

T-Mobile is one of the largest carriers in the U.S., competing with AT&T (NYSE:T) and Verizon (NYSE:VZ). Both these carriers had raised rates last year in a similar move.

Cell phone carriers usually promote costlier plans to customers when they make mobile purchases like the latest versions of iPhones. However, this year has been different because customers are waiting longer to upgrade to newer versions of iPhones owing to the tough macro backdrop. In fact, all three players, TMUS, T, and VZ, have been aggressive in giving discounts on Apple’s (NASDAQ:AAPL) new iPhone 15 devices to customers to entice them to exchange their older devices. Thus, TMUS seems to have decided to increase revenue by upgrading customers’ plans automatically.

What is the Target Price for TMUS?

Yesterday, Wells Fargo analyst Eric Luebchow reiterated a Buy rating on TMUS stock with a price target of $170, implying 19.1% upside potential.

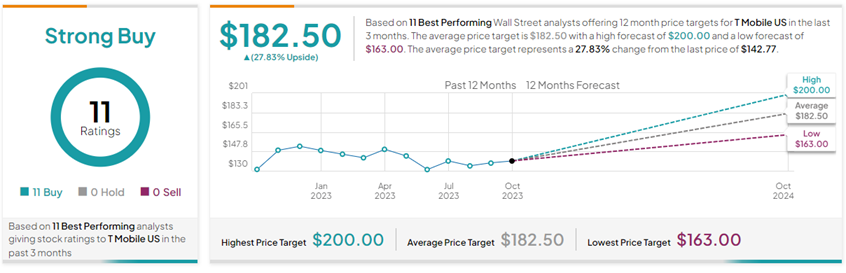

Remarkably, with 11 unanimous Buys from Top Analysts on TipRanks, TMUS stock commands a Strong Buy consensus rating. Top Wall Street analysts are those awarded higher stars by the TipRanks Star Ranking System. This is based on an analyst’s success rate, average return per rating, and statistical significance (number of ratings).

Based on these views, the average T-Mobile price target of $182.50 implies 27.8% upside potential from current levels. Meanwhile, TMUS stock has gained 2.7% so far this year.