Sysco (NYSE:SYY) shares jumped nearly 5% in the opening session today after the food products distributor delivered a mixed second-quarter performance and reaffirmed its financial outlook. During the quarter, revenue increased by 3.7% year-over-year to $19.29 billion. However, the figure lagged expectations by $30 million. EPS of $0.89 fared better than estimates by $0.01.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In Q2, Sysco’s U.S. food service volume increased by 3.4%, and U.S. local volume ticked higher by 2.9%. Alongside driving sales, the company is also maintaining a focus on improving productivity. Notably, its EBITDA jumped by 82.7% to $914.3 million.

Buoyed by this performance, the company has reaffirmed its financial expectations for Fiscal Year 2024. It anticipates EPS in the range of $4.20 to $4.40 on revenue of nearly $80 billion for the year. Moreover, Sysco has returned nearly $705.5 million to shareholders in the form of share repurchases and dividends so far in Fiscal 2024. It plans to return nearly $2.25 billion to investors this year.

What Is the Target Price for SYY?

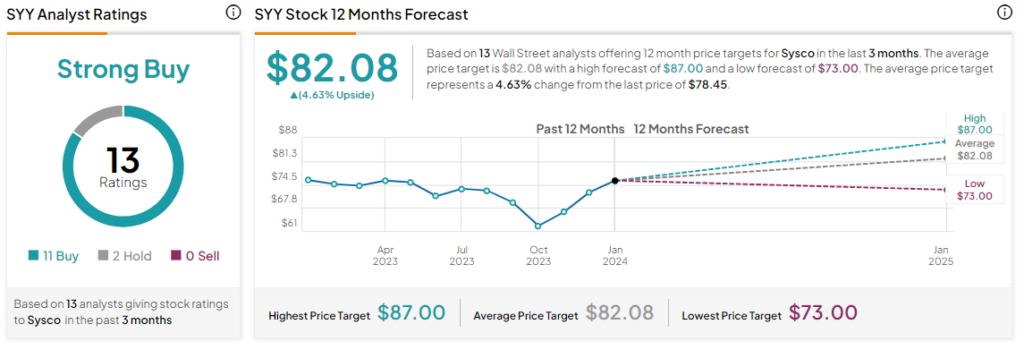

With today’s price gains, Sysco shares have now rallied by nearly 20% over the past three months. Overall, the Street has a Strong Buy consensus rating on Sysco, and the average SYY price target of $82.08 points to a modest 4.6% potential upside in the stock.

Read full Disclosure