Synopsys (NASDAQ:SNPS) delivered better-than-expected Q3 earnings. Moreover, it named Sassine Ghazi, its present COO, the new CEO of the company. Impressively, Synopsys once again raised its full-year outlook, following which its stock closed 2% higher in the after-hours. However, what stands out are the significant AI (artificial intelligence)-led opportunities, which provide a solid base for the company’s future growth.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Investors should note that Synopsys provides electronic design automation (EDA) software used to design and test chips. It also offers semiconductor intellectual property (IP) products. Given the softness in the consumer market, demand for semiconductors remains weak. However, as the use cases for AI are rapidly growing, the company is poised to gain significantly.

With this backdrop, let’s delve into SNPS’ Q3 performance.

Synopsys Beats Analysts’ Earnings Estimate

The company’s top line increased 19% year over year to $1.49 billion, marginally beating the Street’s estimate of $1.48 billion. Meanwhile, its earnings of $2.88 per share handily exceeded analysts’ EPS expectations of $2.74.

Despite the weakness in the consumer market, AI-driven investments in chip and system design activity remain high, supporting the company’s growth.

Thanks to the momentum in its business, the company raised its full-year guidance for the second time. It now expects Fiscal 2023 revenues to be in the range of $5.81 billion to $5.84 billion, up from its previous range of $5.79 billion to $5.83 billion.

Moreover, it expects its adjusted earnings to be between $11.04 to $11.09 per share, up from its earlier guidance range of $10.77 and $10.84.

Names New CEO

In addition to better-than-expected quarterly results, the company announced Sassine Ghazi would assume the role of President and CEO effective January 1, 2024.

Aart de Geus, the company’s current CEO, will assume the role of Executive Chair of the Synopsys Board.

Is SNPS a Good Buy?

Synopsys stock has gained over 34% year-to-date. Meanwhile, the company remains the leading EDA provider to AI chip designers, which will support its growth in the coming quarters. Further, a growing number of semiconductor vendors are using its AI product, Synopsys.ai, in the production process, which is encouraging.

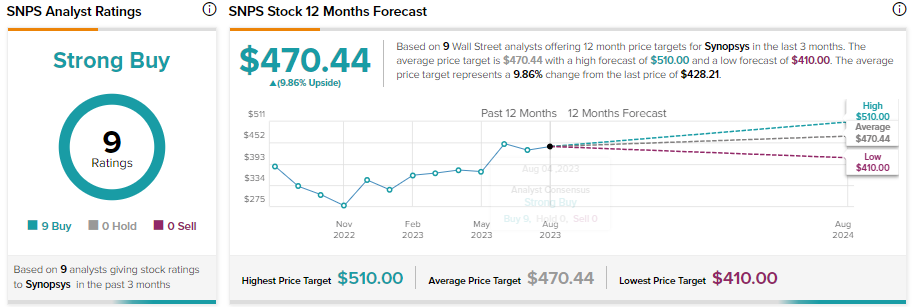

All of these are good news for Synopsys, keeping analysts bullish about its prospects. Given the AI-driven opportunities, the stock has received nine unanimous Buy recommendations from Wall Street analysts for a Strong Buy consensus rating. These analysts’ average 12-month price target of $470.44 implies 9.86% upside potential from current levels.