Syndax Pharmaceuticals reported a better-than-expected loss in the fourth quarter and outpaced analysts’ expectations for revenues. Shares of the clinical-stage biopharmaceutical company dropped 1.2% to close at $23.30 on March 8.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Syndax (SNDX) incurred a loss of $0.44 per share in 4Q, compared to the $0.49 loss per share estimated by analysts. Total revenue came in at $380,000, topping analysts’ expectations of $200,000.

The company’s research and development expenses were $15.5 million in the quarter, up 63.2% year-over-year. Total operating expenses stood at $20.2 million, up 38.4%. (See Syndax stock analysis on TipRanks)

Syndax CEO Briggs W. Morrison said, “We expect 2021 will be a year of immense progress across our two highly promising programs aimed at addressing key areas of unmet need, coupled with a sharp focus on pipeline expansion.”

“Notably, we plan to present data from the Phase 1 portion of our ongoing AUGMENT-101 trial of SNDX-5613, our selective menin inhibitor, in patients with acute leukemias,” Morrison added.

For 2021, the company projects research and development expenses to be in the range of $90 million to $100 million. Total operating expenses are anticipated to range from $110 million to $120 million.

For 1Q, research and development expenses are forecasted to be in the range of $25 million to $30 million, with total operating expenses in the range of $30 to $35 million.

Following the 4Q results, Stifel Nicolaus analyst Konstantinos Aprilakis maintained a Buy rating and a price target of $39 (67.4% upside potential) on the stock as the analyst is “enthusiastic about the menin space.”

Aprilakis expects “the company to continue finding success with SNDX-5613, its lead asset and menin/MLL inhibitor for potential use in acute leukemias, and axatilimab, an anti-CSF-1R antibody currently being developed in cGVHD.”

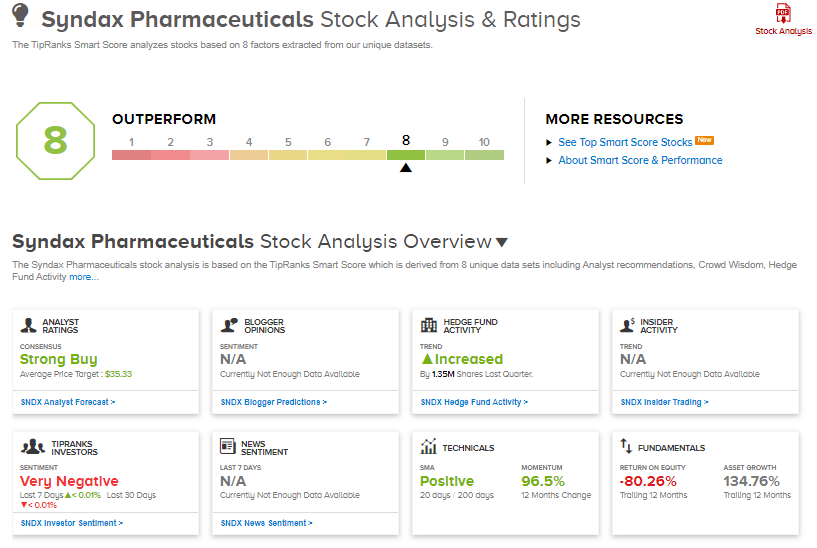

Syndax shares have exploded almost 108% over the past year, while the stock still scores a Strong Buy consensus rating based on 3 unanimous Buys. That’s alongside an average analyst price target of $35.33, which implies 51.6% upside potential to current levels.

Additionally, Syndax scores an 8 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Hibbett 4Q Profit Exceeds Estimates As E-commerce Sales Boom; Shares Tank 4%

Big Lots’ 4Q Profit Beats Analysts’ Estimates As Comparable Sales Rise; Shares Gain 2%

Cooper’s 1Q Results Beat The Street Consensus; Street Says Buy