No sooner did satellite and streaming music giant SiriusXM (SIRI) recover from the Howard Stern situation than it rolled out a brand new potential draw. This new feature got some analysts quite interested, as it was well-timed and offered some exciting new potential for the platform. Investors seemed pretty happy about it as well, judging by the modest gain in Sirius stock in Tuesday morning’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

So for those not already familiar with the move, SiriusXM is bringing a “limited-run” channel of Taylor Swift music, timed to launch just ahead of her new album going live. The channel will have everything you might expect, particularly loads of Taylor Swift music from all her various eras. Live performances will be included—though probably they will be previously-aired recordings rather than actual live performances—along with music from the new release as well.

This is already prompting some to wonder if the power of Taylor Swift—which already gave movie theaters a boost back when the Eras Tour came out—can give some new life to SiriusXM. Some have already pointed out that earlier efforts like artist tie-ins and trying to piggyback on return to office mandates by having drivers “…reimagine their commute” have been of mixed effectiveness.

The Surprising Dividend Value

One point that works very much in Sirius’ favor is its dividend, which has been fairly stable, and rising over the last year or more. In fact, a new report noted that investors that bought just over 9,250 shares of SiriusXM today would be able to realize around $10,000 in annual dividend income.

Since SiriusXM also has decent cash flow metrics by some reports, the end result is a surprisingly stable platform that may represent a decent, worthwhile dividend operation.

Is SiriusXM Stock a Good Buy?

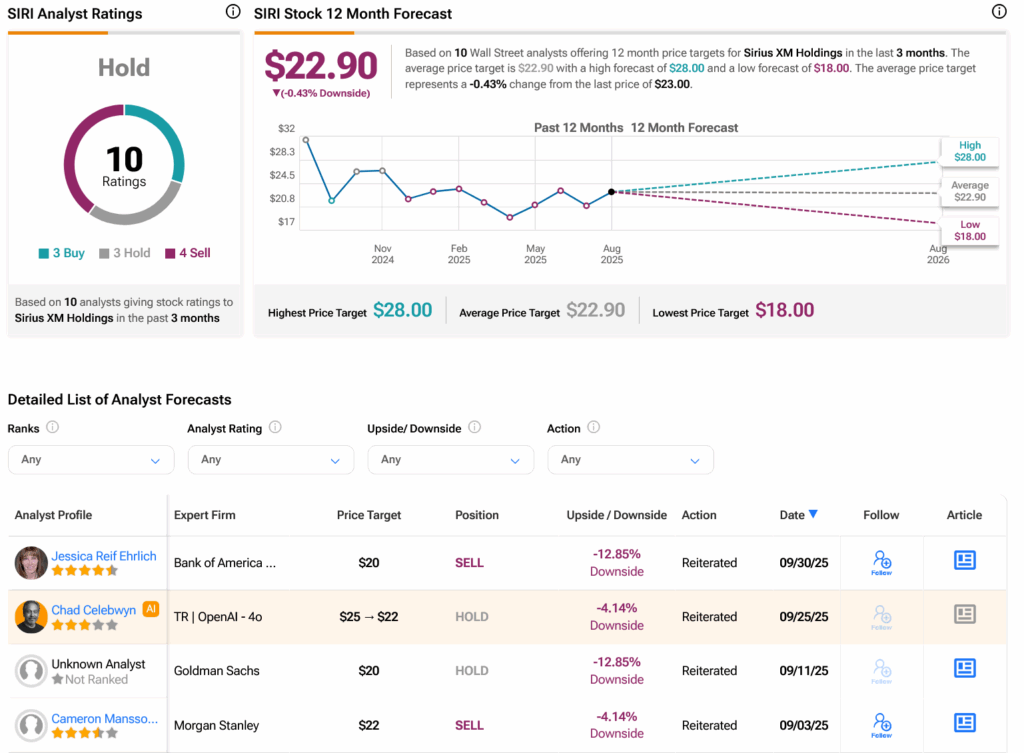

Turning to Wall Street, analysts have a Hold consensus rating on SIRI stock based on three Buys, three Holds, and four Sells assigned in the past three months, as indicated by the graphic below. After a 0.13% rally in its share price over the past year, the average SIRI price target of $22.90 per share implies 0.43% downside risk.