SVB Financial Group (NASDAQ:SIVB) reported its Q4 earnings on Friday, with its revenues beating the estimates. The company’s stock soared by almost 17% after the announcement.

The company posted quarterly revenue of $1.53 billion, against an estimate of $1.49 billion. However, the earnings per share of $4.62 fell short of the estimate of $5.29.

For the full-year 2022, the income available to shareholders declined by 14.7% to $1.5 billion, as compared to $1.8 billion in the same period a year ago. The company’s revenues were driven by a higher volume of loans and fees, but higher expenses pulled the profits down.

During the year, the company’s venture capital business was heavily hit due to the tough last two years for start-ups and higher cash burn. However, this segment has started showing signs of stabilization, and the company’s management remains confident it can navigate through these headwinds.

Greg Becker, President, and CEO, SVB Financial Group, said, “While broader market conditions are limiting growth and driving somewhat higher credit costs, we continue to see strength in our underlying business, and a balance by our clients between near-term expense discipline and preparation for a return to investment and deployment.”

SVB Financial Group is a financial services company that offers a range of financial products and services to its customers.

Is SVB Financial Group a Buy?

SVB’s stock has gained 25.6% in the last three months, after having fallen by close to 50% in the last year.

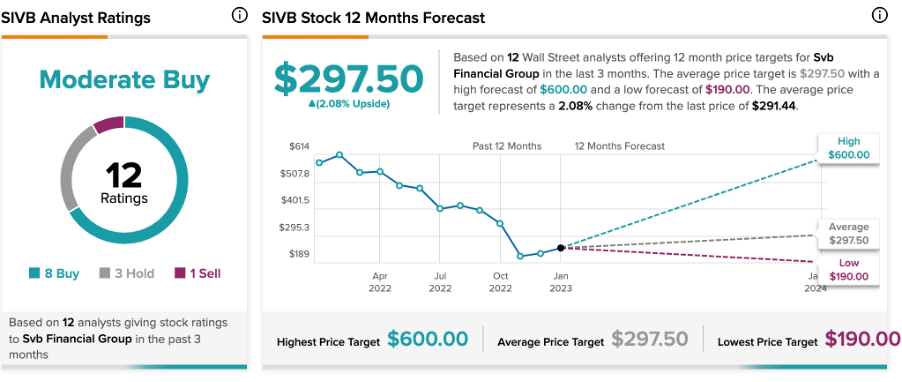

According to TipRanks’ analyst consensus, SVB stock has a Moderate Buy rating. The stock has a total of 12 recommendations, which include eight Buy, three Hold, and one Sell recommendations.

The SIVB price forecast is $297.5, which is 2.08% higher than the current price.

Join our Webinar to learn how TipRanks promotes Wall Street transparency