Superior Gold (TSXV:SGI), a gold producer that operates in Australia, reported its third-quarter results earlier today, which contributed to the stock falling by 4%. Please note that all figures are in U.S. dollars unless otherwise stated. Last year, SGI’s quarterly revenue was $34.2 million, but in Q3 2022, it fell to $25.7 million, missing estimates by about $1 million. Additionally, its adjusted earnings per share came in at -$0.03 ($0.042 in Canadian dollars), lower than the positive $0.01 reported in the same period last year. Still, those results beat the -$0.043 consensus estimate (-$0.06 in Canadian dollars).

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Superior Gold’s production also dropped by 18% year-over-year to 15,946 ounces but registered a 5% gain on a sequential basis. The company attributed its lower production to lower grades. Meanwhile, SGI sold 14,875 ounces, but its costs to sell this gold increased by 33% year-over-year to $1,789/oz due to lower production, which caused a deleveraging effect.

Similarly, SGI’s all-in sustaining costs increased by 37% to $1,989/oz. The problem here is that the average realized gold price during the period was $1,722/oz, making Superior Gold an unprofitable, high-cost operation at current gold prices. Its high costs are attributed to higher capital expenditures, cash costs (the $1,789/oz mentioned above), and exploration efforts. The company even temporarily suspended its mining operations at Main Pit Deeps due to poor performance.

On a more positive note, its operational safety is improving. Its total reportable frequency rate, a safety measure (the lower, the better), fell 27% year-over-year and 56% year-to-date. Also, the company obtained A$10 million in debt financing in early October, providing it with extra liquidity.

Is Superior Gold Stock a Buy, According to Analysts?

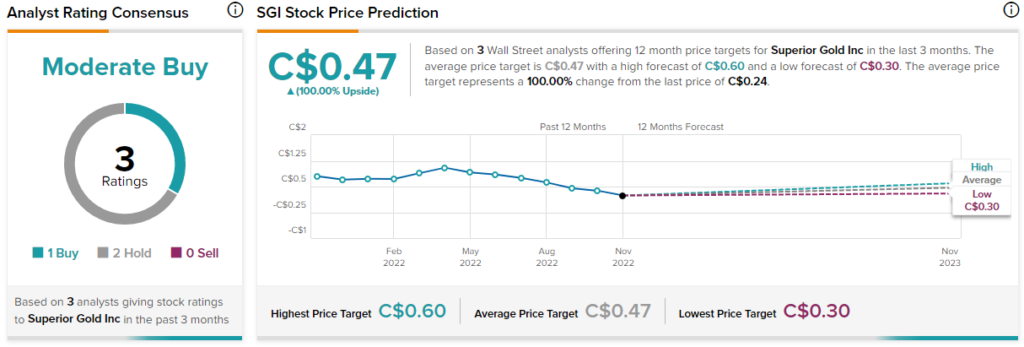

According to analysts, Superior Gold stock comes in as a Moderate Buy based on one Buy and two Holds assigned in the past three months. Interestingly, at C$0.47, the average SGI stock price target implies 100% upside potential.

Conclusion: Superior Gold is Facing Trouble

Overall, while earnings beat estimates, Superior Gold isn’t in the best shape right now. Its profitability has worsened, as the company has been unable to keep its costs down while the price of gold has dropped. Nonetheless, analysts expect the stock to double.